Be as detailed as you want to be

Send a simple payment request or a full-fledged invoice with line items, discounts, and taxes. Plus, add your logo for personalization.

Create, send, and track invoices from Relay. No extra tools needed.

Relay is a financial technology company and is not a bank. Banking services provided by Thread Bank2, Member FDIC. The Relay Visa® Debit Card is issued by Thread Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa cards are accepted. The Relay Visa® Credit Card is issued by Thread Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc and may be used everywhere Visa cards are accepted.

Manage income where you’re doing all of your banking.

Send invoices and automate client payment reminders.

Collect payments directly into your checking account.

Create, send, and track invoices right where your money lives.

Send a simple payment request or a full-fledged invoice with line items, discounts, and taxes. Plus, add your logo for personalization.

There are multiple secure ways to pay: ACH, wire, pay-by-bank, credit card, and debit card.

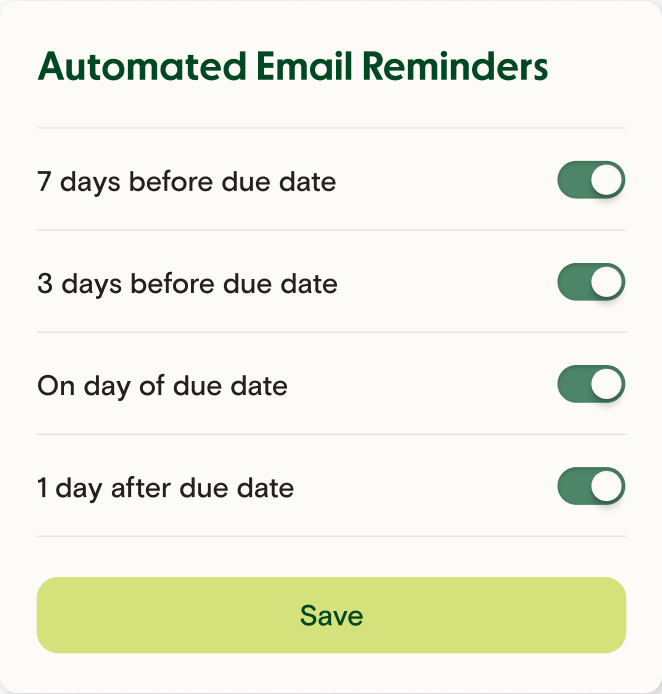

Take invoicing off your already-long to-do list.

Invite employees, bookkeepers, or accountant to Relay so they can take care of receivables for you.

Let Relay send automated reminders before and after due dates, for on-time payments without the manual work.

Payment and cash flow tools bundled together for every part of the small business journey.

For solopreneurs and businesses just getting started.

Business banking essentials and simple tools to give you complete cash flow clarity.

Apply NowBanking

1.03% APY1

on savings accounts

1% cash back*

on credit cards

Bills & expenses

Bill creation, intake & management

Cards with built-in spend policies

Receipt collection & storage

Invoicing

ACH debit +1% of transaction amount

Payment request links

Invoice creation & tracking

Accounting integrations

Quickbooks

Xero

For small teams with growing cash flow complexities.

Tools and automations to put you in control of financials and free of shortfalls.

Trial Grow for 14 daysBanking

1.75% APY1

on savings accounts

1.25% cash back*

on credit cards

Everything in Starter, plus

Bills & expenses

Savings on payment fees

Multi-step bill approval rules

Customizable bookkeeping automation

Partial bill payments

Invoicing

ACH debit +0.75% of transaction amount

Branded invoices

Recurring invoices

For larger teams that want to scale more, faster.

AI-powered automation and insights to help you save time and max out margins.

Trial Scale for 14 daysBanking

3.03% APY1

on savings accounts

1.5% cash back*

on credit cards

Everything in Grow, plus

Bills & expenses

10 free same-day ACH per month

Bill payment automation

Out-of-policy spend requests

Invoicing

ACH debit +0.5% of transaction amount

AI-powered collections agent

Insights

Cash flow insights & forecasts

And more...

Special offers from Relay partners like Xero and Engine

Faster customer support by phone and email

A best-in-class security certification

Relay is SOC 2 Type II certified, providing enterprise-level security to protect our customers and data.

Never expose account details

Your account details are never included on payment request links or invoices—only a safe pass-through account.

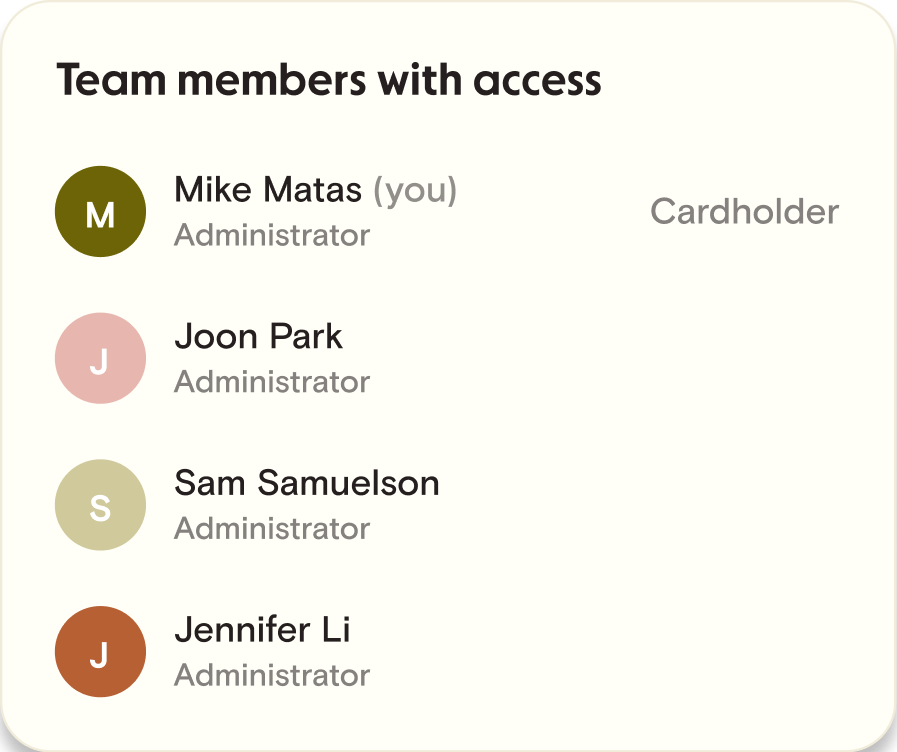

Control who sees and does what

Give advisors and employees the exact level of access they need, and revoke it in just a few clicks.

I looked into several banking options, but Relay stood out for its simplicity and focus on supporting small business owners like me. Their platform isn’t just about banking—it’s built to empower entrepreneurs to grow and manage their businesses seamlessly.