Never lose

a receipt

again

Capture receipts the moment a purchase happens. Categorize your expenses automatically to keep track of every dollar spent. And sync your accounting software to stay effortlessly audit-ready.

Stop losing receiptsRelay is a financial technology company, not a bank. Banking services are provided by Thread Bank; Member FDIC. The Relay Visa® Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

Meticulous expense tracking without the receipt chasing

1

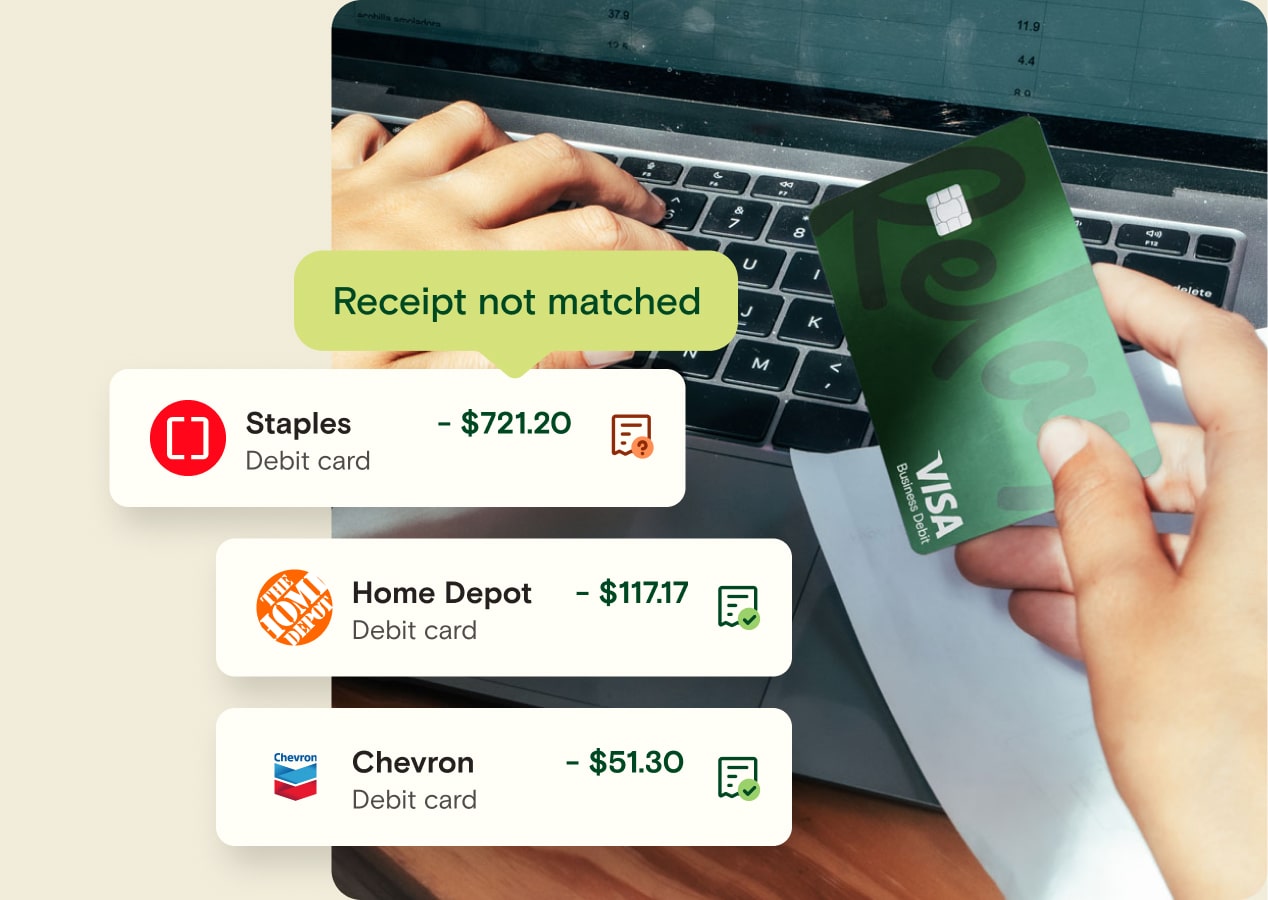

A receipt for every expense

Set receipt collection requirements for card transactions so team members always know when they need to collect proof. We’ll do the chasing for you with instant text reminders and keep you posted with a list of receipts that are still missing.

2

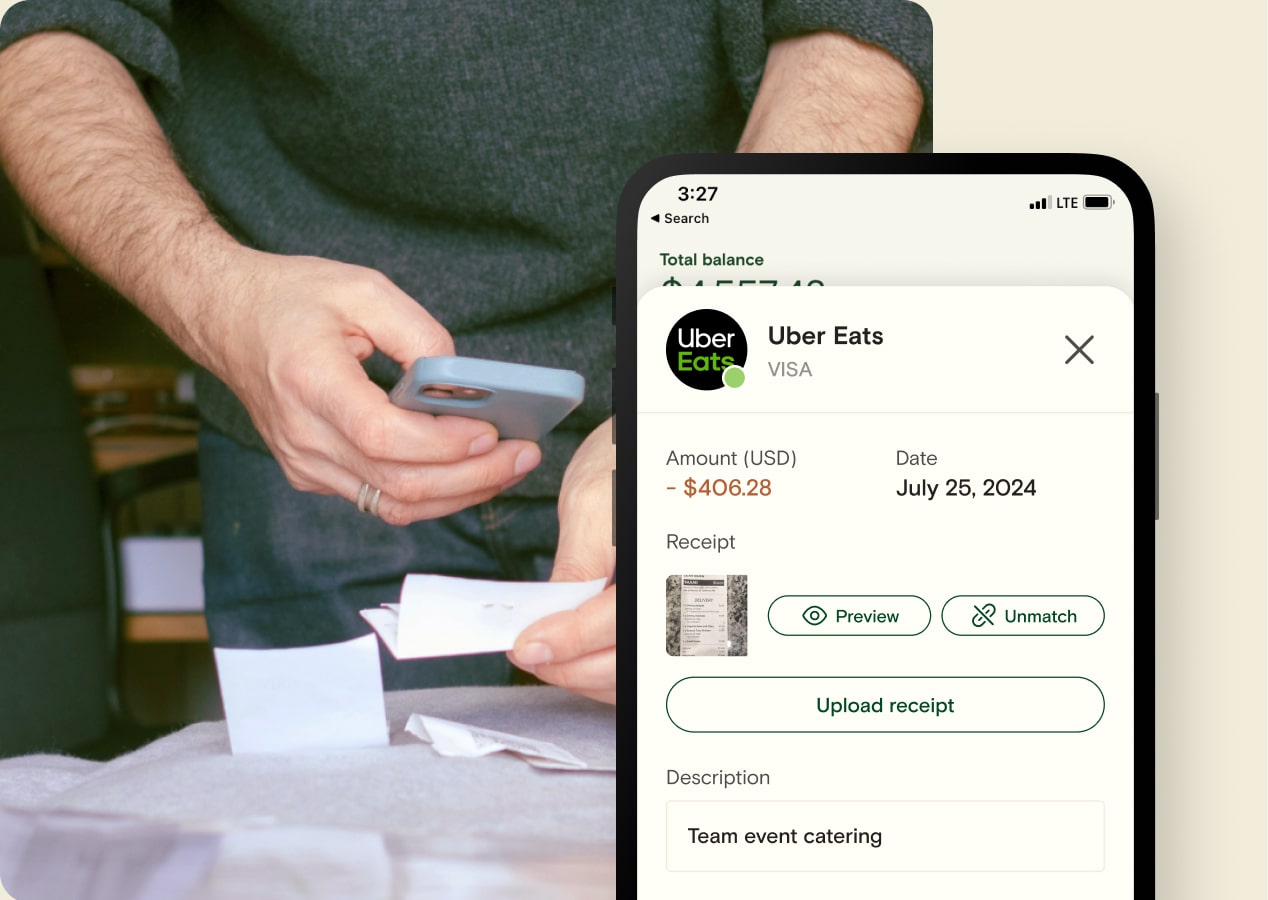

Digital proof before it goes poof

We make it easy for cardholders to snap pictures of receipts before they wind up crumpled and lost. Digital or paper receipts can be uploaded or email-forwarded to Relay in seconds, so they’re safely stored and easily found when you need them—forever.

3

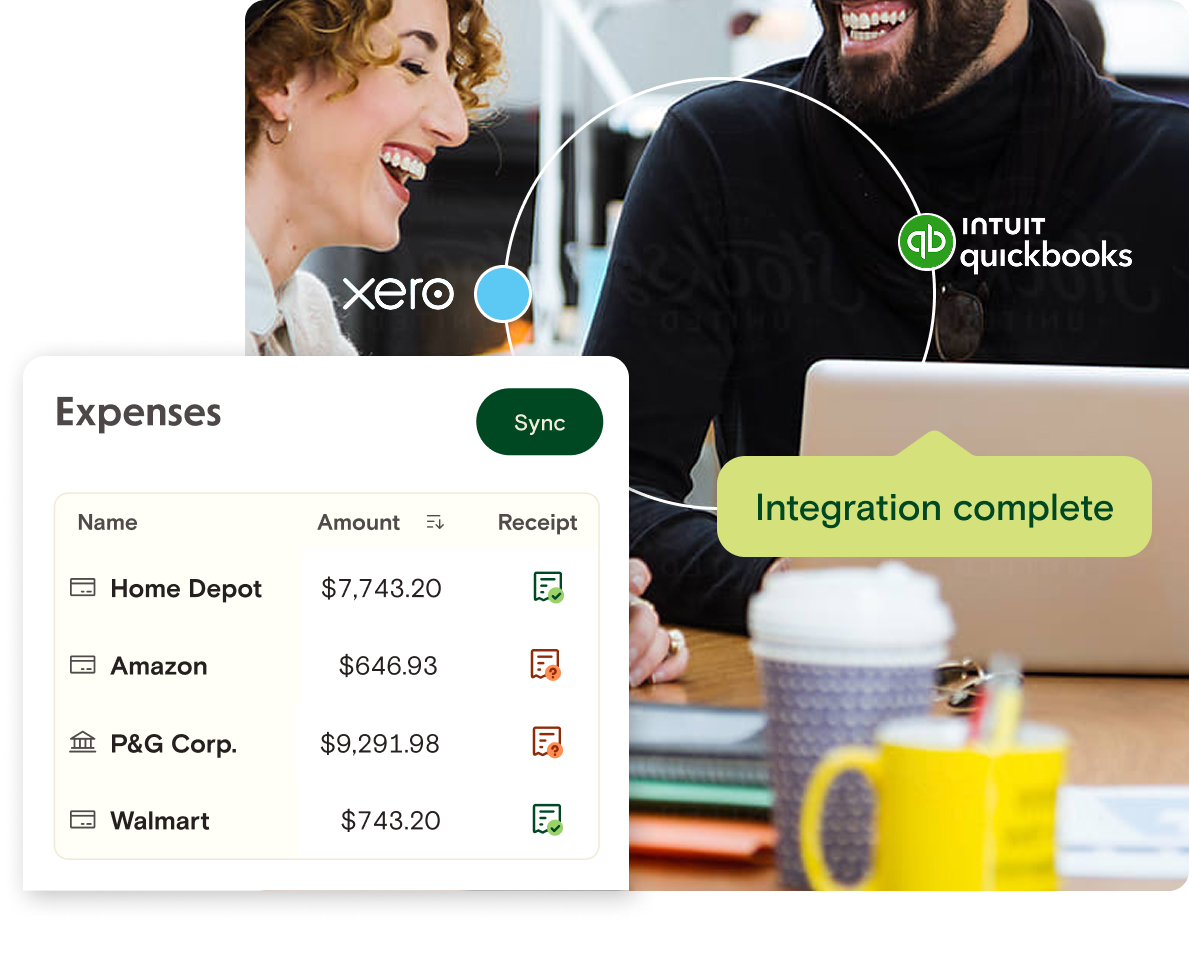

Reconcile your books in record time

Categorize expenses in Relay, with the receipts and context at your fingertips—then sync them to Xero or QuickBooks Online. Plus, AI automates the data-entry for your fastest month-end reconciliation ever.

Don’t clean it up at the end. Get it right from the start.

Make saving receipts a happy habit

Instant reminders make sure you—and your team—snap a receipt photo the moment a purchase happens. The proof you need gets safely stored before it ends up crumpled and lost.

Always be audit-ready

Stay organized and ready for the IRS with digital proofs for every purchase. No more hunting through inboxes or receipt boxes—just straight-talking numbers and stress-free audits.

Empower team spending without messy reimbursements

Using Relay cards alongside a receipt policy gives you a safe and secure way to enable team spending—no personal cards or expense reports required. From coffees to car rentals, all employee expenses can be covered without the reimbursement rigmarole.

Get a jump-start with AI and automation rules

Create smart accounting rules (with an AI assist), so you’ll never have to code expenses one-by-one ever again. Relay will automatically categorize every lumber purchase as Supplies or every coffee receipt as Meals—giving you a head start on your month-end every time.

What small businesses are saying about Relay

Keeping your business on the money

Relay’s online business banking platform puts you in control of your cash flow. See all the ins and outs without any blind spots or doubts.

No hidden fees, overdraft fees, or minimum balances

50 virtual or physical Visa® debit cards

Give your business a cash flow cushion with the Relay Visa® Credit Card

Up to 20

checking accountsUp to 2 savings accounts with up to 3.03% APY1

Send and receive via ACH transfers, wires, checks, Stripe, Square, and more

Make banking collaborative with role-based user permissions for team members, accountants, and bookkeepers

Get personalised customer support when you need it by phone, email, or chat

Direct integrations with QuickBooks Online and Xero

You can stop chasing employees for receipts now

And your accountants and bookkeepers will stop chasing you, too.

Stop the monthly receipt hunt