Business banking that completes your accounting tech stack

- Reliable bank feeds that sync directly into QuickBooks Online and Xero

- Ultra-detailed transaction data for lightning-fast reconciliation

- Secure access to client banking using your own login

Get a personalized walkthrough of Relay

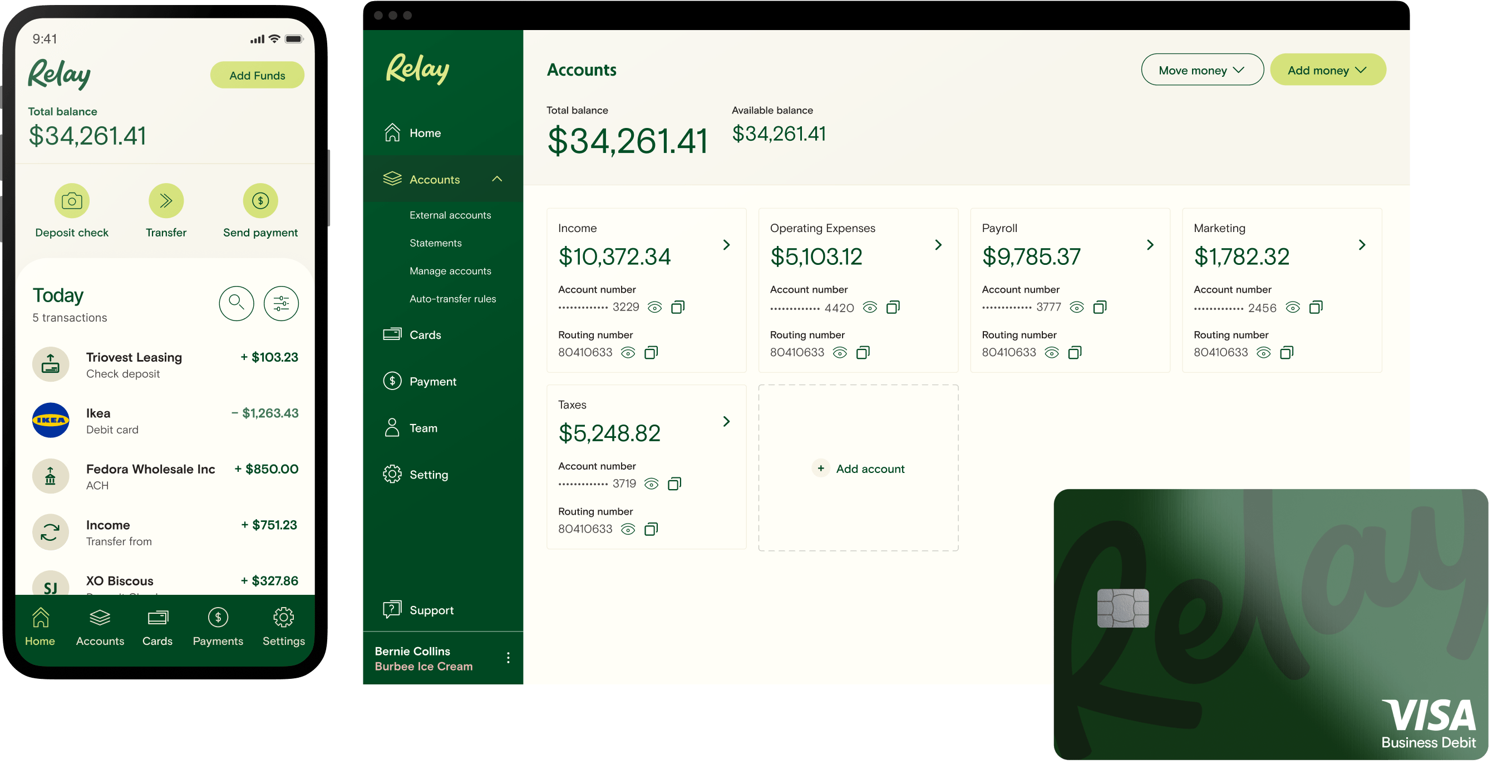

Powerful, Online Small Business Banking

Relay centralizes day-to-day banking, expense management, accounts payable and big-picture cash flow management into one account for each of your small business clients.

- Up to 20 individual checking accounts

- Savings accounts with up to 3.03% APY1

- Physical or virtual credit and debit cards

- Payments via ACH transfer, check and wire

- Receipt collection and storage

Official banking platform of Profit First Professionals

Empower your firm and your clients with a banking platform that truly supports the Profit First method.

Just 3 steps to start

- 1

Meet your account manager

Your dedicated account manager will show you how easy it is to use Relay.

- 2

Set up your partner portal

Create your firm’s account and get familiar with Relay’s features.

- 3

Bring clients on board

Your account manager will help you get clients set up and banking with Relay.

Grow your firm with Relay’s Partner Program

Deepen your business banking expertise, consult clients on cash flow with total confidence, and get rewarded as you grow with Relay.

- Manage all client banking from a single login

- Earn $50-$300 per client onboarded to Relay

- Find new clients through Relay’s Advisor Directory and Ambassador Program

- Join a thriving community of advisors

Your Accounting

Tech Stack, Completed

Unlike traditional business banking, Relay was designed to fit into your workflow—not complicate it. Collaborate with clients more effectively using banking features specifically designed for accountants and bookkeepers.

- 1

Bank feeds that don’t break, skip or duplicate

Reconcile accounts faster with reliable bank feeds that sync directly into QuickBooks Online and Xero. No more disconnecting, reconnecting and testing bank feeds. That’s a lot of time saved.

- 2

Safe, hassle-free access to client accounts

Log in to client accounts using your own credentials. Never share a password again, and be rid of 2FA code timeouts. And let each client set your level of access.

- 3

Speedy reconciliation with ultra-detailed transaction data

Stop Googling and chasing clients for clarification on spending. Sync pre-categorized card transactions with clean, standardized vendor names directly into QuickBooks Online and Xero. And see check images for all check deposits and a memo for all outgoing payments.

- 4

Expense management meets banking

Stop chasing clients for receipts. Use receipt policies to make sure cardholders match every Relay card purchase to a receipt. Create smart rules to automatically categorize expenses. And then sync to Quickbooks Online and Xero for 10x faster month-end reconciliation.

- 5

Simple, convenient bill payments baked into client banking

On the app or desktop, pay bills directly from your client’s account using ACH transfers, checks and domestic and international wires (with built-in currency exchange).

- 6

Banking and cash flow advisory put into action

Safely help clients with day-to-day tasks—like issuing or freezing cards, provisioning banking access to employees, and approving or denying payments made from their check book. Plus, help clients organize and apportion income into dedicated checking accounts for operating expenses, payroll and taxes.

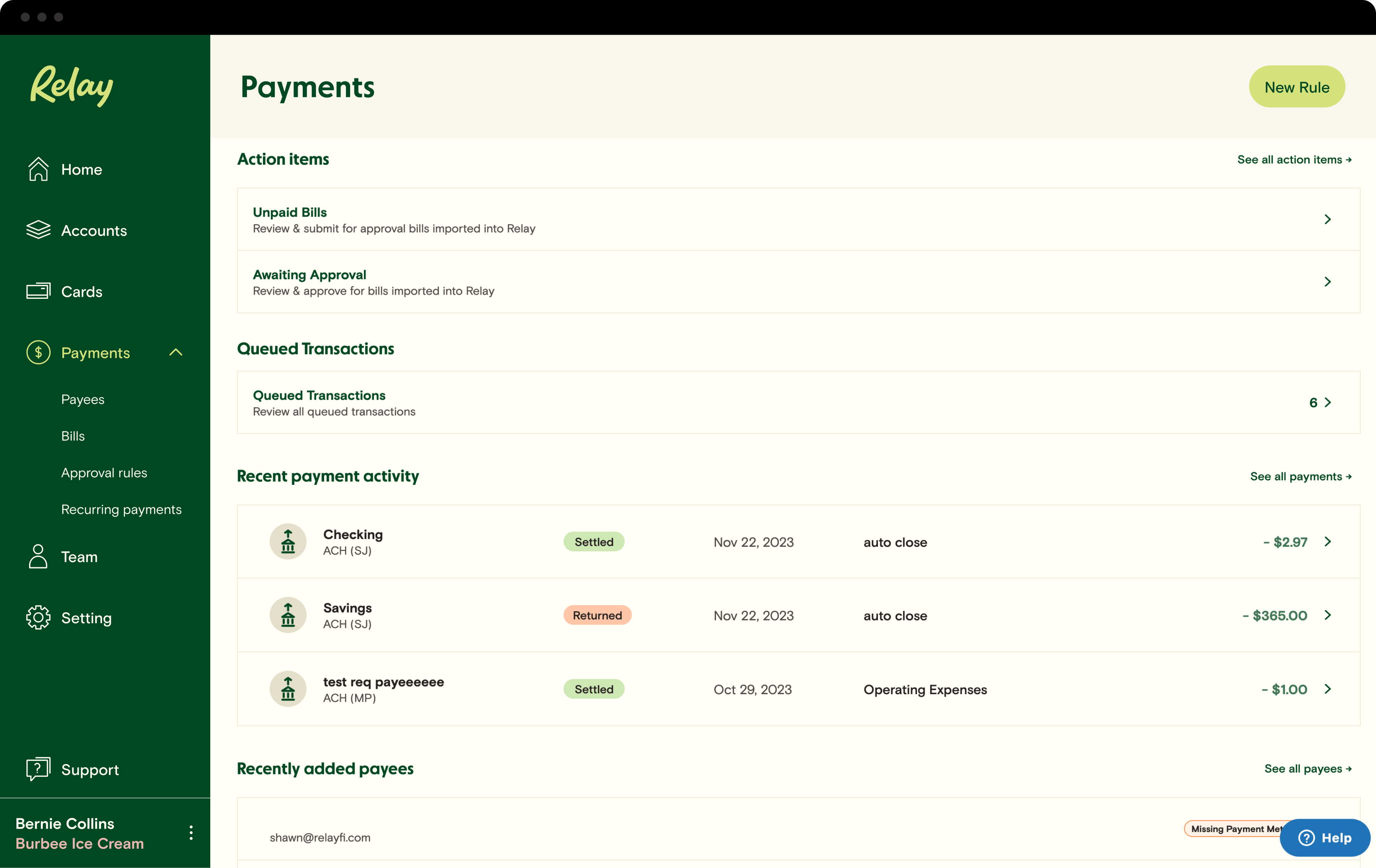

Centralize accounts payable and business banking

One less app in your tech stack. Manage, pay and reconcile bills without leaving Relay.

Learn moreabout accounts payable

- Create, upload and email-forward bills. Or import from QBO and Xero.

- Set up automated single- or multi-step approval rules for all payments

- Categorize bills before they sync to your accounting software.

You and your clients get access to knowledgeable support specialists dedicated to understanding what you both need to achieve your goals. We’re happy to help, and we’re available by email.

Learn more about Relay's support