TakeCharge

The Credit card that puts you in charge

Take control with the Relay Visa® Credit Card. Stop the cash flow crunch, and keep team expenses in check by putting a spend policy on every employee card.

Available to Relay customers by invitation only.

Apply nowThe Relay Visa® Credit Card is currently available to eligible Relay customers by invite only. Relay is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC. The Relay Visa® Credit Card is issued by Thread Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc and may be used everywhere Visa credit cards are accepted.

1.5% cash back*

Earn up to 1.5% cash back* on every purchase

30 day billing cycle

Monthly cycle for smarter spending

$0 annual fees

Spend without tying up your cash flow

The Cash Flow Safety Net

your business needs

Walk the tightrope with confidence

You just ran payroll, utility bills are due and you’re chasing a customer for a late payment. With the Relay Visa® Credit Card in your corner, you can spend through the toughest days and keep shortfalls at bay.

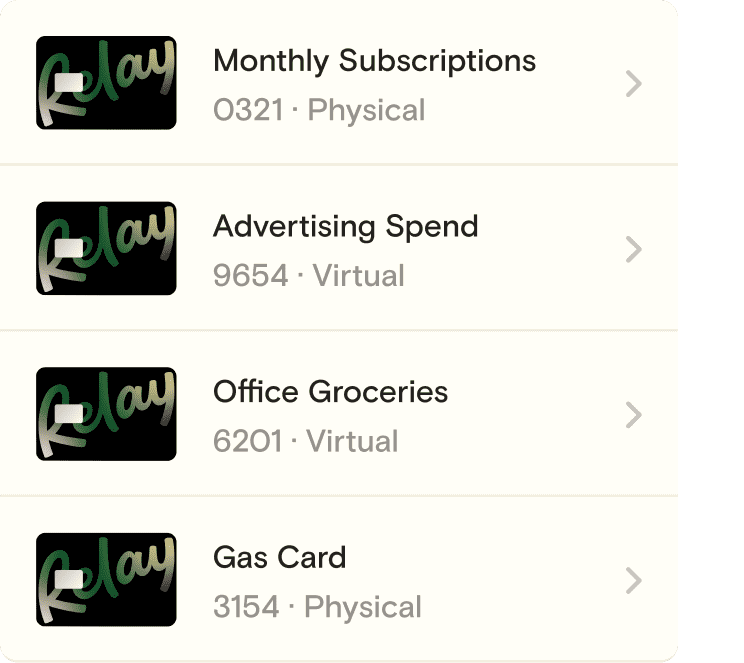

Meticulously organize all spending

Categorize expenses—from the start—with a customized credit card for every employee, spend category, project and vendor.

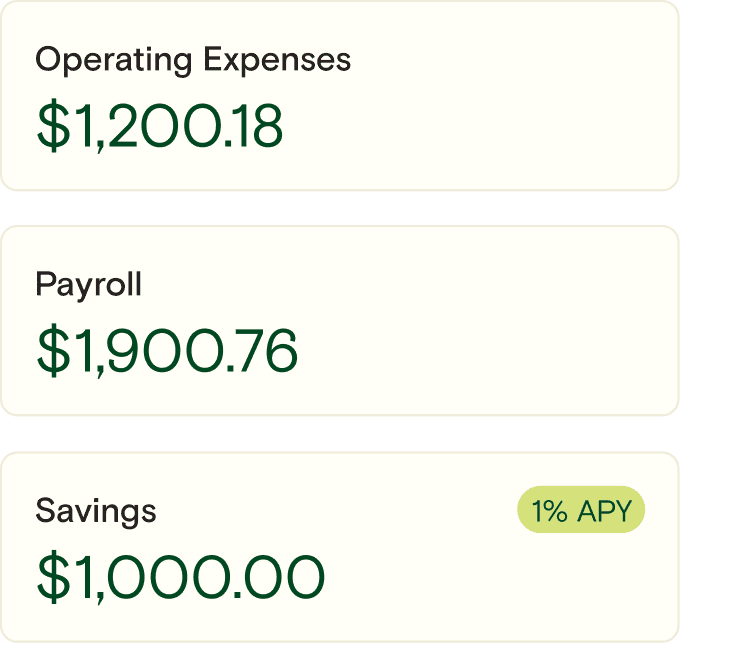

All money moves in one place

Get complete cash flow clarity by bringing together credit, checking and savings into one platform. You’ll have one central system to instantly see how all your money works. Then you can stay ready, save faster, and make smarter decisions.

Secure, trackable and

controlled-by-you team spending

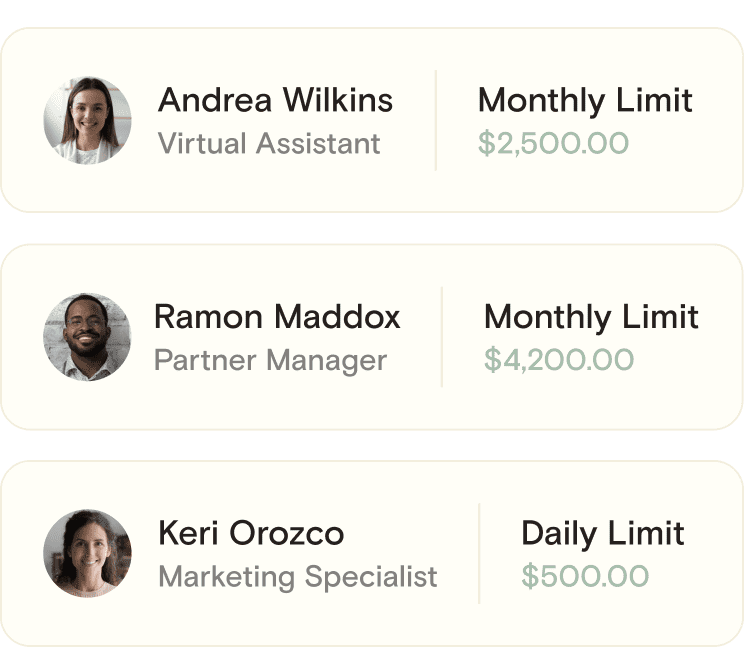

A credit card for every employee

No more expense reports or messy reimbursements. Empower employees with their own credit cards. Plus, track spending and freeze cards in seconds.

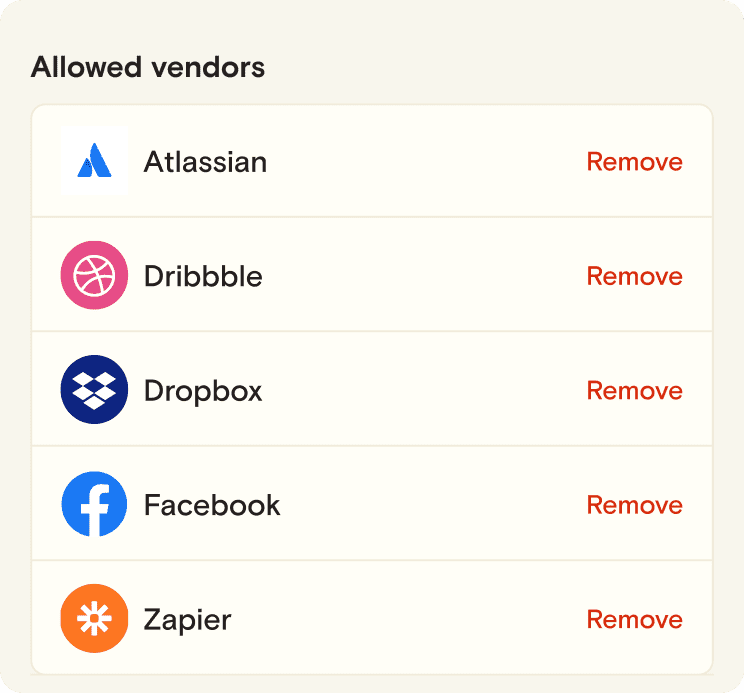

Stay in charge of every card

Set a spend policy for every employee card. Use approved vendors and categories—and daily or monthly spend limits—to guarantee your money is always spent wisely.

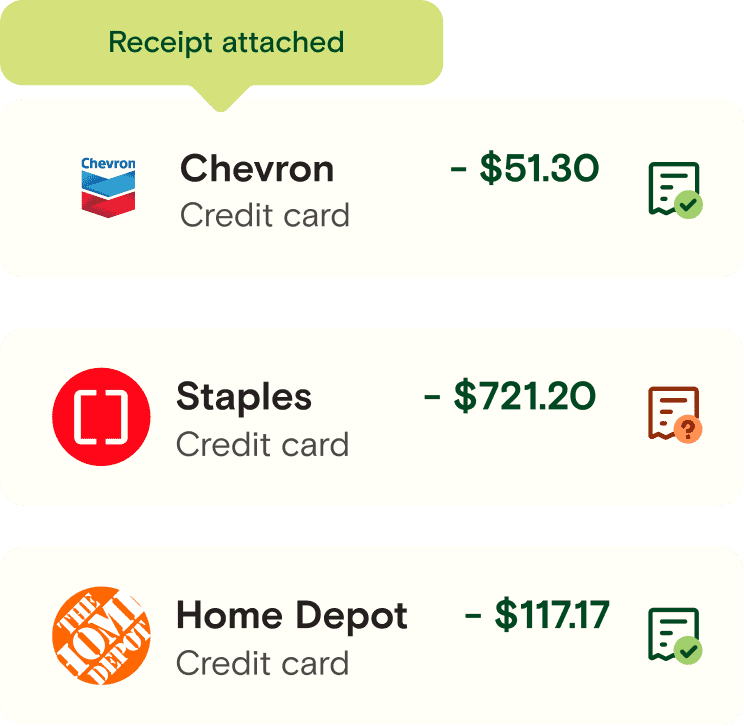

Track everything now, chase nothing later

Get ultra-detailed data for every purchase made by an employee. Stay on top of every dollar and make month-end bookkeeping super speedy.

Plus, Relay makes sure employees add a receipt to every expense.

Learn more about Relay's expense management tools here

.

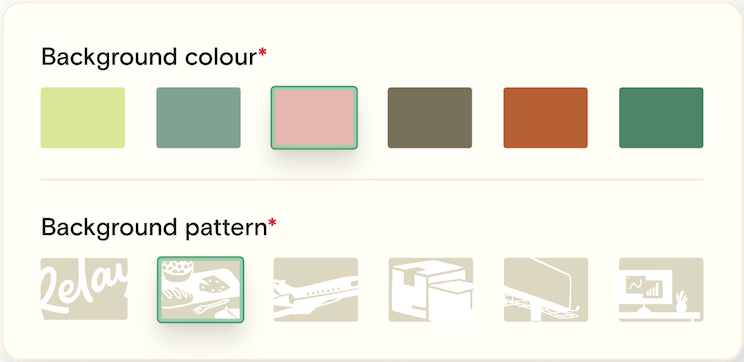

Customize cards with purpose

Choose from 30+ unique designs by pairing colors with spend category illustrations. Always find the right card at checkout or when managing your team spending.

Loving my transition to Relay after years with traditional banks.

Everything is so streamlined and easy. Finally, easy access to funds, wires, transfers, virtual cards for employees, and no ridiculous fees.

Keeping your business

on the money

Relay’s online business banking platform puts you in control of your cash flow. See all the ins and outs without any blind spots or doubts.

Banking without hidden fees that tie up cash flow

20 everyday checking accounts to organize cash and expenses

Automated savings that earn up to 3.03% APY1 on idle cash

All the payment types you need—ACH, wire and check

Safe, productive collaboration with team members and advisors

Personalized customer support when you need it

You’ve got questions,

we have the answers.

More details can be found in our Support Center.