Today we’re officially announcing the launch of our first credit product, the Relay Visa® Credit Card, now available to qualifying Relay customers by invite only.

Relay is a financial technology company and not a bank. Banking services are provided by Thread Bank, Member FDIC. The Relay Visa® Credit Card is issues by Thread Bank, Member FDIC, pursuant to a license from VISA U.S.A. Inc. and may be used anywhere Visa cards are accepted.

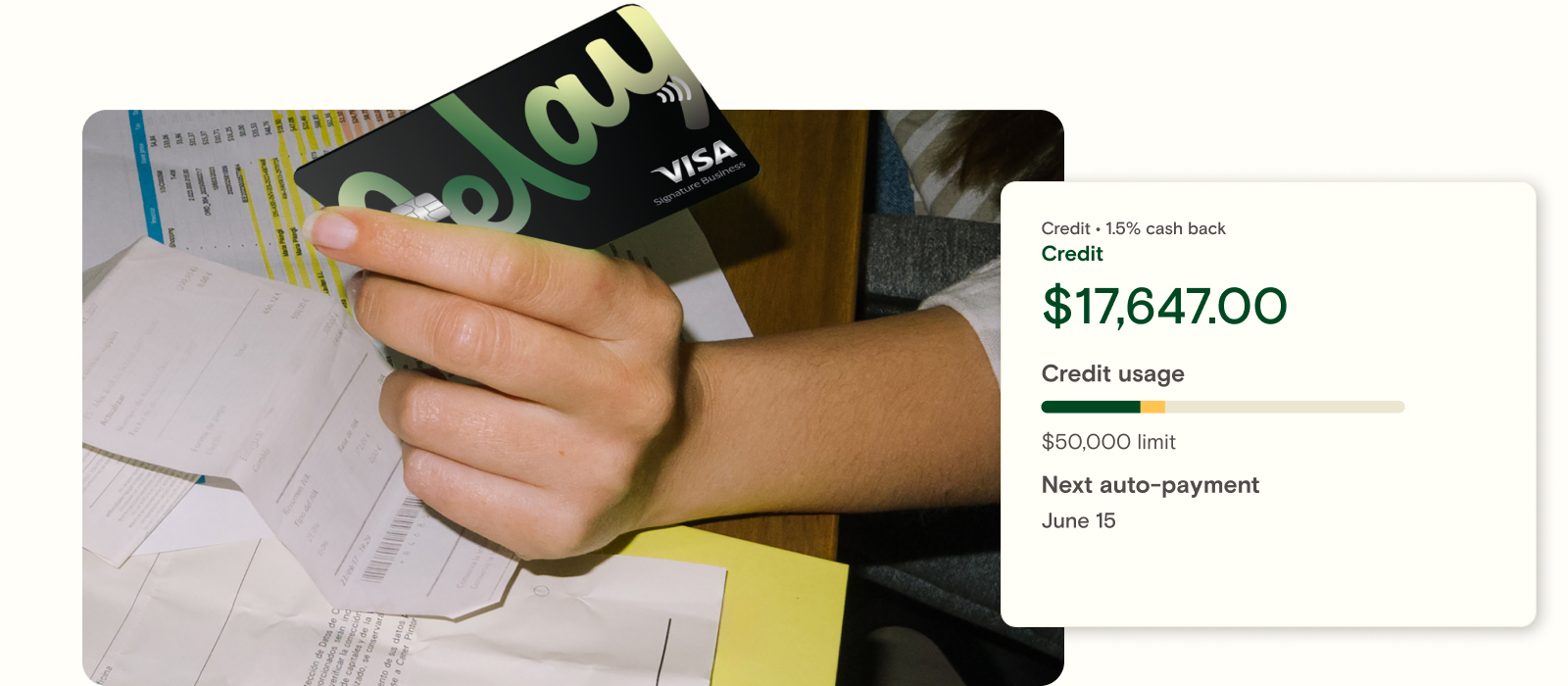

With credit in your back pocket, you have a financial safety net that allows you to keep business running as usual, even when facing unexpected cash flow challenges. Plus, earn 1.5% cash back* on all business spending (no minimum spend required 🤯).

You’ve worked hard, put in the hours and effort, and your business is finally running like a well-oiled machine. Your clients are happy. Your profits are growing. You’ve even found room in the budget to give yourself a small raise...and this is the precise moment when a big fat cash flow curveball lands directly in your lap. Whether it's a supplier hiking their prices or a vital piece of equipment that suddenly needs replacing, the result is the same: your masterful planning and careful budgeting are thrown completely out of balance, and you're left scrambling to find a solution.

That’s where credit can step in. Having reliable access to credit can be a game-changer on your toughest days, providing the safety net your business needs when a cash flow challenge arises. The new Relay Visa® Credit Card is exactly that—a cushion for your cash flow, paired with all the clarity, cash management, and team spending features you’ve come to expect from Relay.

Here’s a look at everything you get by adding the Relay Visa® Credit Card to your banking toolkit.

Stay on top of surprise expenses, even when cash is tight

Imagine facing a coffee spill-induced need for a new laptop—the laptop where you run all your operations from—but cash is tight after you hired two new team members and just paid rent. You can’t put your business on hold until that late check from your big client clears. Luckily, you can put the new laptop with all the bells and whistles on your Relay Visa® Credit Card, and pay it back later when you have more cash on hand.

You’ll never be left in the lurch when an unexpected cost occurs with a 30-day safety net under your cash flow, helping you and your team spend confidently throughout the month. Alongside your Relay checking and savings accounts, you’ll have a complete system for managing cash flow in one central location—and a bird’s-eye view of how money moves through your business, letting you stay ready, save faster, and make smarter decisions.

Control spending with ease

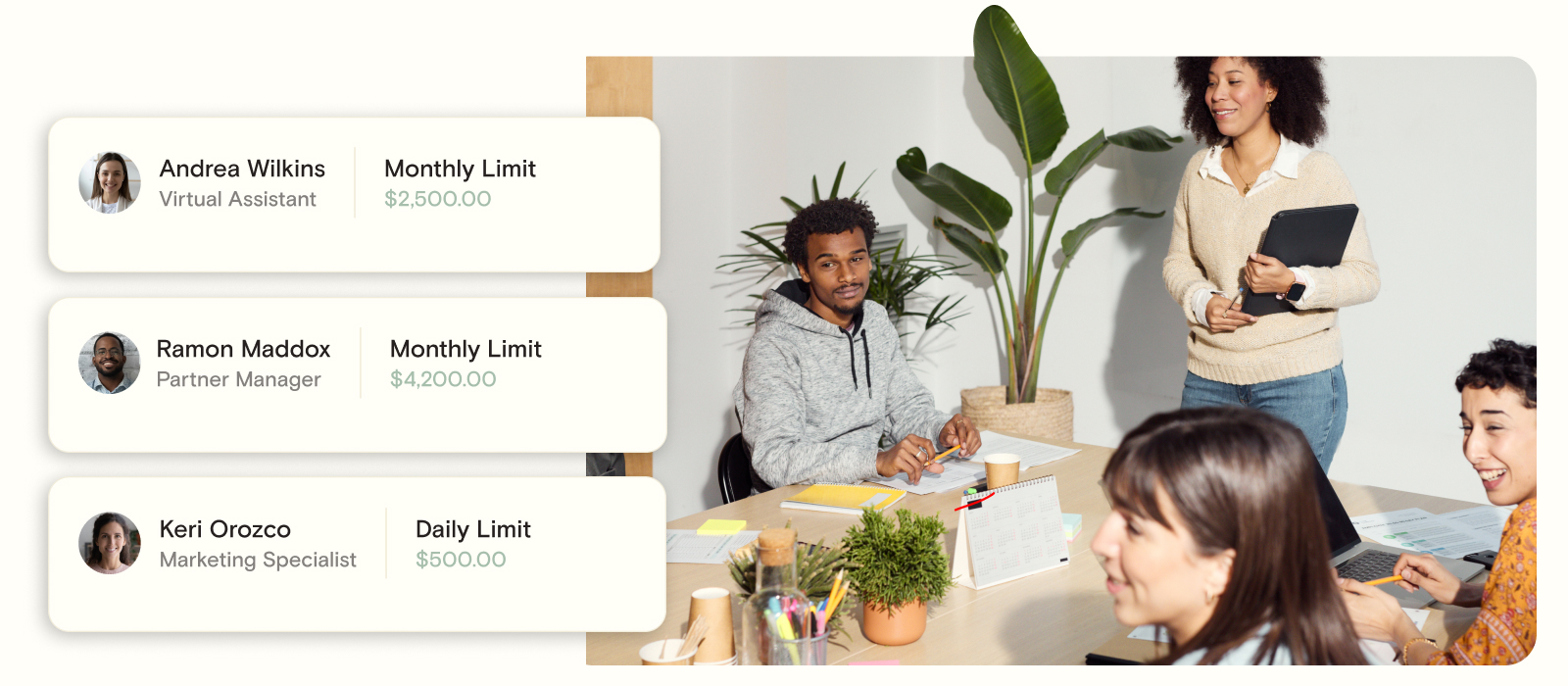

Take charge of spending from the jump instead of trying to manage your money after it's already been spent. With the Relay Visa® Credit Card, knowing where every dollar is going is easier than ever.

Stay on top of every cent

Organize expenses as they are charged by creating a card for every spend category, project, and vendor. Set a spending limit for every card so you and your team never spend more in a certain category than you’ve budgeted. Plus, you can be as particular as you want, setting approved vendors and categories for each card (blocked vendors and categories too!), ensuring you stay on top of every cent before it gets spent.

In other words, you stay in complete control of how every dollar moves through your business.

Say “so long” to reimbursements

Goodbye expense reports, hello centralized team spending! Assign a Relay Visa® Credit Card to every employee who needs one. For every card assigned to an employee you can set a spending limit, approve vendors or categories (or block them!) and let Relay chase your team for receipts so you don’t have to. That means saying ‘See ya!’ to reimbursements, now that your team never needs to use a personal card for a business expense.

Work within a complete, centralized system

Centralization is your banking crystal ball, allowing you to plan, budget, and prioritize the money moves that make the biggest impact on your business. This new credit tool doesn’t miss a beat, stepping in to work alongside the Relay features you already use every day. The centralization of credit, debit, and savings offers an additional layer of insight, leading to better financial decisions, an increased ability to save, and the power to map out your business’s bright future.

Benefits you can cash in on

Did we mention cash back with no annual fees? Here are all the benefits you’ll have as a Relay Visa® Credit Card cardholder:

Up to 1.5% cash back*: It pays to use your Relay Visa® Credit Card—literally. Earn 1.5% cash back on all purchases made on your credit card. Uber across town? 1.5% cash back. Dinner for you and your top clients? 1.5% cash back. A huge haul of materials needed for the job site? You guessed it, 1.5% cash back. Your cash back reward is applied to all spend put on your credit card within the 30-day billing cycle.

Your cash back reward is applied to all spend put on your credit card within the 30-day billing cycle.

A 30-day billing cycle: The Relay Visa® Credit Card is a charge card, so you pay off your full balance at the end of every 30-day billing cycle. Spread your spending now without worrying about falling short later.

No annual fees: The Relay Visa® Credit Card does not have any annual fees, letting you enjoy the benefits of your card without any hidden costs. Relay does charge a late fee for balances that are not fully paid at the end of every 30-day billing cycle.

Your Relay Visa® Credit Card completes your Relay toolkit, designed to fit seamlessly into your everyday operations. Managing your cash flow and facing unexpected challenges is easier than ever with detailed account transaction data, no annual or monthly fees, and the ability to empower team members to make purchases while tracking spending and setting limits as you see fit—all with 1.5% cash back on every purchase made.

Ready to take charge? Learn more about the application process here.