Sending money internationally has become a fundamental part of running a modern business, but dealing with unexpected fees and slow transfers can put a dent in your plans—and your cash flow.

Imagine: You’re finalizing payment to an overseas freelancer who just delivered a game-changing project. Or maybe you’re sourcing critical inventory from a supplier halfway across the globe so that you can be prepared for next season.

These cross-border moments are becoming more common for business owners, and essential for growing success, but when it comes time to send the payment—well, that’s where things get overwhelming.

International payments often come with uncertain timelines, hefty transaction fees, and sometimes even unpleasant last-minute surprise bank fees on top.

At Relay, we understand that you need to know exactly when and how your payment is going to arrive—and what it’s going to cost.

That’s why we’re excited to announce the launch of Local Network international wires, a new way to send cross-border payments that’s faster and more cost-effective than ever before.

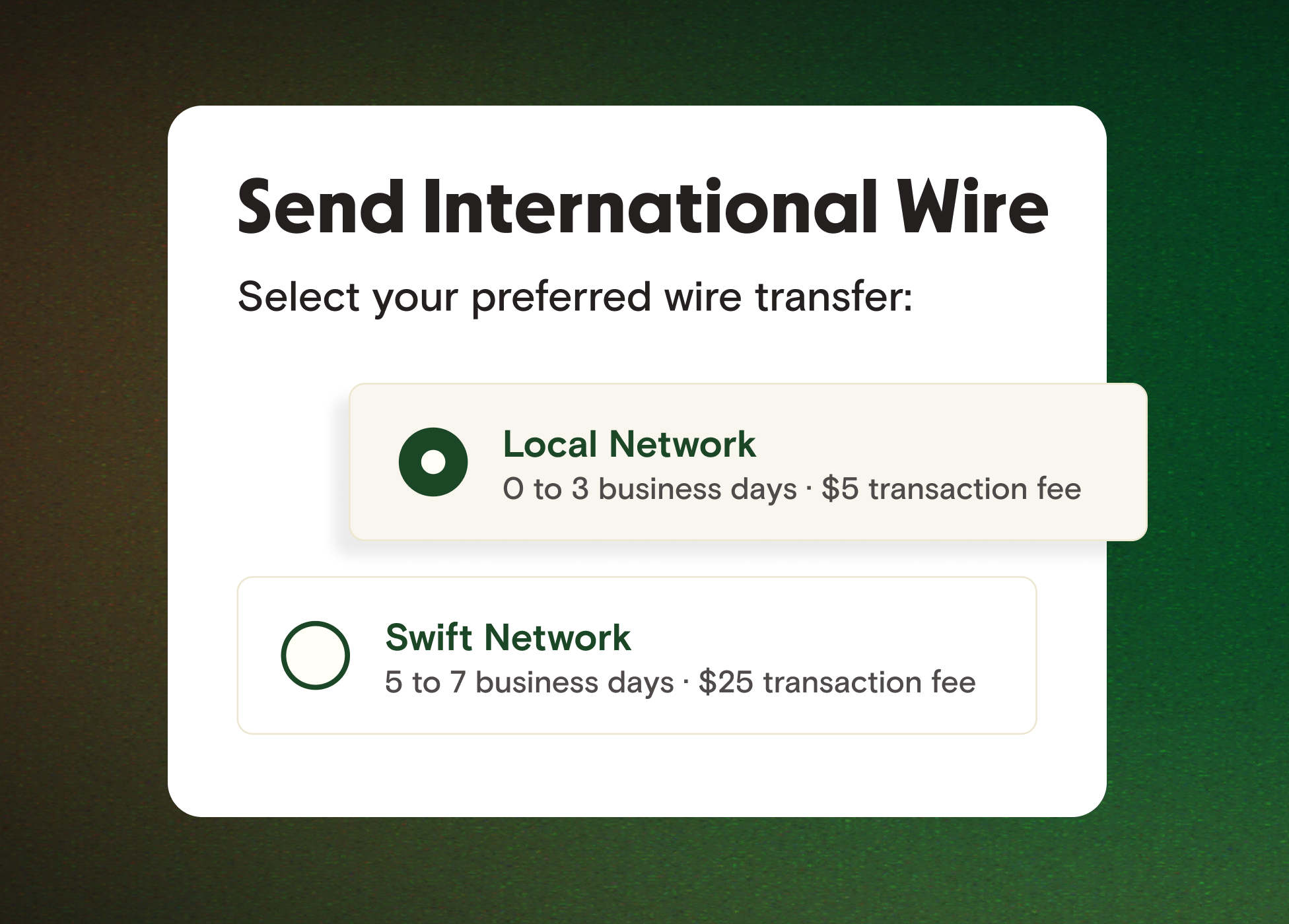

Starting January 31, 2025, you’ll have two distinct options for sending international wires: Local Network and Swift Network.

But which option should you use and when? Here’s everything you need to know to make the right choice for your business.

Local Network international wires: the TL;DR

Sending an international wire via Local Network is inexpensive and fast, making it perfect for frequent transactions. This is a new option, which is now available to all Relay customers. Here’s the TL;DR on sending international wires with Local Network:

Each wire only costs $5 to send (or $0 if you’re a Relay Pro subscriber) plus an exchange fee, making it an extremely affordable way to send payments internationally

It arrives within three business days

It is available in the four currencies most commonly used by Relay customers: 🇪🇺Euros, 🇬🇧British pound sterling, 🇨🇦Canadian dollars and 🇦🇺Australian dollars

Swift Network international wires: the TL;DR

You also have the option to send international wires via the Swift Network (which used to be the default way of sending international wires in Relay, and which we’ll continue to support going forward). Using the Swift Network is more expensive, but it does have important benefits. Here’s the TL;DR on sending international wires with Swift Network:

Each wire costs $25 to send (or $20 if you’re a Relay Pro subscriber)

It arrives within seven business days

You can send it in 30+ currencies, and choose the currency that your recipient gets (USD, their local currency, or any other currency of your choice). If you choose to convert the currency, a currency conversion fee applies.

You get detailed end-to-end tracking via a MT103 report, which makes it perfect for sending larger transactions that you want to follow every step of the way

Your payment, your choice

When sending an international wire in Relay, you’ll now see the option to select Local Network or Swift Network—along with helpful tips to guide your choice based on your cost, speed, and tracking preferences.

Both methods of sending international wires will get your funds where they need to go. Each of them has their pros and cons. No matter which wire option you choose, Relay remains one of the most simple, transparently-priced, and competitive options for sending international payments. Traditional banks charge up to $40 per international wire—plus additional interchange fees, intermediary bank fees, and recipient bank fees.

All of those fees can add up quickly, especially if you’re sending numerous wires a month. Here’s an overview of the difference between the two networks:

| Local Network | Swift Network |

How it works | Payments are sent using the local payment network in the region or country where your payee is located. | Payments are sent using the Swift network, a group of 11,000 financial institutions that have agreed to transfer money internationally. |

Cost per wire | $5 per international wire, or $0 for Relay Pro subscribers | $25 per international wire, or $20 for Relay Pro subscribers |

Supported currencies | 🇪🇺 Euro (EUR) 🇬🇧 British pound sterling (GBP) 🇨🇦 Canadian dollar (CAD) 🇦🇺 Australian dollar (AUD) | 30+ currencies. See list here. |

Currency conversion fee | Local Network wires are sent in USD and must be converted to the recipient’s local currency. As currency conversion is required, a fee of 1% to 1.5% of the payment applies. | Swift Network wires are sent in USD. You can convert the payment into any of Relay’s supported currencies. If you choose to convert to another currency, a fee of 1% to 1.5% of the payment applies. |

Settlement time | 0-3 days | 5-7 days |

Payment tracking | An MT103 is not available for Local Network wires but our Customer Experience Team can work with you to locate an in-progress payment. | An MT103 will help you trace a wire payment every step of its way to your recipient. Learn more about MT103s here. |

Best for | Faster and more affordable wires, perfect for small and frequent transactions. | Sending large wires that require detailed end-to-end tracking. |

There are also slight differences in the payment cutoff times and transaction limits for each wire type. Please visit the Help Center for a detailed breakdown by currency.

How currency conversion impacts your wire transfer

As a small business based in the U.S., you probably operate your business in US dollars. When sending money abroad, should you convert USD to the local currency?

The choice is yours, and here’s what you should consider:

If you send your wire via the Local Network, you must convert to your payee’s local currency.

Whenever you choose to convert your currency within Relay—whether sending via Swift Network or Local Network—a currency conversion fee of 1% to 1.5% of the payment applies.

You’ll be able to see this fee in your Relay account before you hit send. That way, you know exactly what you’re paying and exactly how much your payee will receive.

If you send your wire via the Swift Network, you can choose whether or not to convert from USD to any currency (your payee’s local currency or any other currency).

If you choose to keep your transaction in USD, you avoid paying currency conversion fees at the moment of sending, but you risk incurring surprise handling & exchange fees upon arrival. Your payee’s receiving bank may charge additional fees for receiving USD. They may also charge exchange rates of up to 10% when converting USD to another currency.

These costs can add up quickly—and banks don’t always clearly explain how the fees are calculated. It can be hard to know how much money your payee will actually receive and, as the sender, the risk falls on you.

The bottom line is: it’s only a good idea to send USD to your payee if you have explicitly agreed upon it or if they have a USD account themselves. Otherwise, always convert your money to their local currency first.

Send international wires in Relay

Managing cross-border transactions shouldn’t be a headache—or a drain on your resources.

With the introduction of Local Network international wires, you get a faster, more affordable option for sending money internationally in the four most popular currencies.

And with continued support for Swift Network international wires, we’ve still got you covered for those big transactions that need tracking and all the other currencies you might need.

So go on—hire that great logo designer from Australia or take a chance on that small-batch supplier in Canada.

With Relay, you’ll be able to pay them via the method that best fits your needs, without worrying about big surprise fees or super long settlement timelines.

A banking solution that makes your international wires easier, more affordable, and more transparent doesn’t have to be a dream. Sign up for Relay today and take advantage today.