Today, we’re announcing that Relay has raised a total of USD $19.4 million, including a $15 million Series A led by Bain Capital Ventures with participation from Better Tomorrow Ventures, Garage Capital, Tribe Capital, Panache and Amaranthine.

We’re so proud of the work our team has put in to get here, and motivated by the vote of confidence from our investors. And most importantly, we’re excited about how this funding will allow us to more deeply serve our customers. We’re on a mission to build a banking platform that not only saves business owners time and money, but actually makes their businesses more successful.

We’re building banking to help small businesses succeed

82% of small businesses fail due to cash-flow issues, and traditional banking is a big part of this problem.

Any small business owner knows the pain of simply trying to open a bank account for their business — the paperwork, the lineups at the branch, the time spent on hold waiting to speak to a human. And even once your account is set up, your bank doesn’t do anything to actually enable your business to succeed. Traditional business accounts are expensive — often charging steep, unnecessary fees — and are disconnected from the other systems your business relies on. This, coupled with the lack of support, can make it really difficult for business owners to understand their own financial status.

These are pains we’ve heard time and again from the many business owners we’ve talked to over the years. In the early days of Relay, I went door-to-door in Toronto to talk to small business owners. It was clear that the day-to-day challenges of trying to grow their business caused financial management to take a back seat. One conversation that has always stood out was with Wanda, founder of Wanda’s Pie in the Sky — a truly iconic Kensington Market business! — who candidly shared the sacrifices she’d made to keep her business afloat over the last 20 years. There was an obvious opportunity to create banking that would give business owners like Wanda increased financial visibility and confidence in their standing.

Today, we serve an extremely wide range of customers, from countless main street businesses like Wanda’s, to one of Shopify’s fastest-growing ecommerce stores, to real estate and property management firms, to marketing agencies and consultancies. One thing they all have in common is a desire to create security and clarity in their business finances.

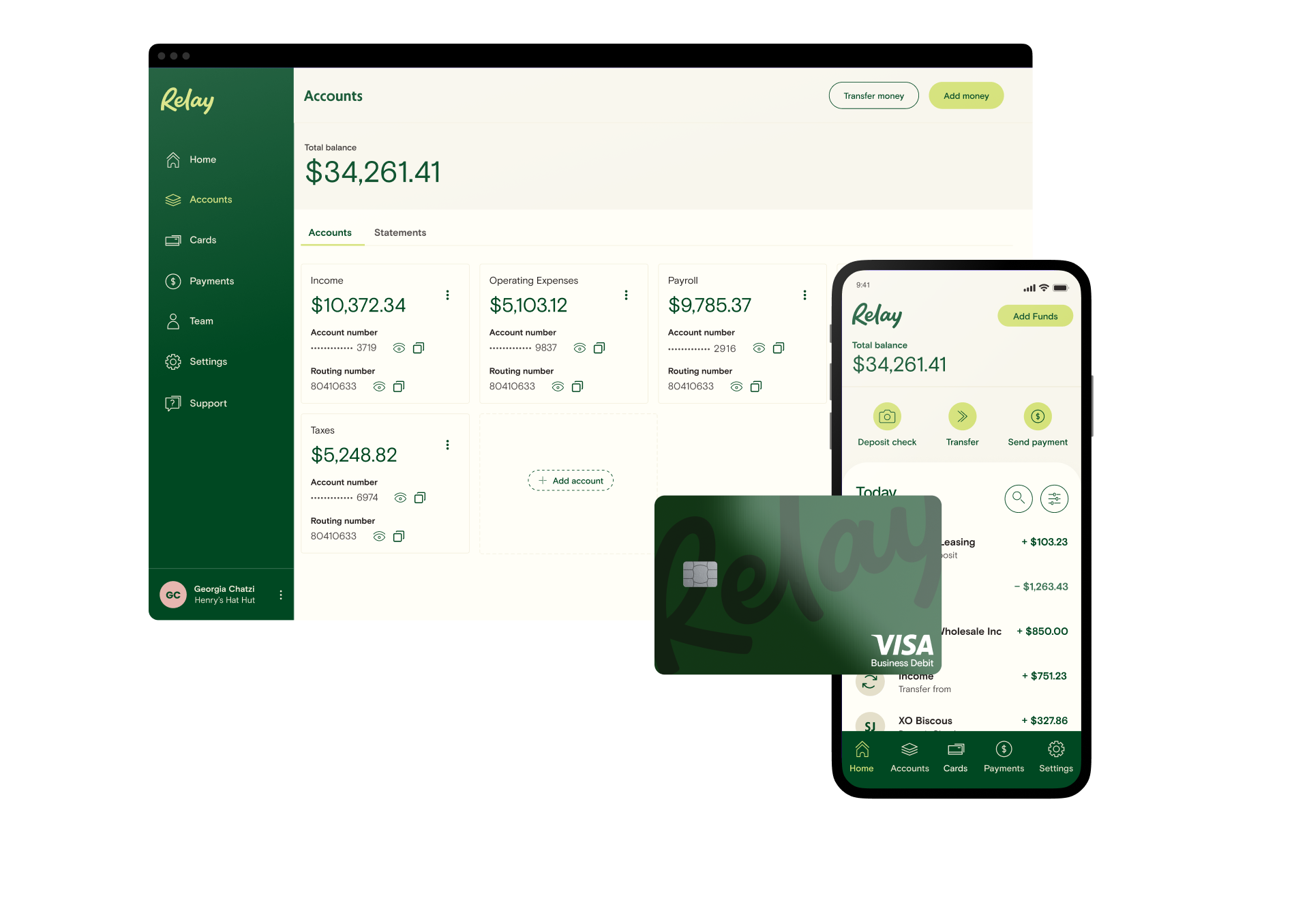

We’re building a banking platform that gives small business owners more visibility into their financial standing. Cash flow shouldn’t be confusing. The only way that happens is if the tools that power the SMB back office are truly integrated — and that includes your bank. Our vision is to automate financial management so small business owners can always have clarity and confidence around every dollar in their account.

Subscribe to On The Money

Monthly newsletter from Relay, covering the latest news for your small business

SubscribeHow we’re doing it: by deeply integrating into how small businesses really operate

We believe banking can and should be the financial nerve centre of your business, with integrations that reach into every part of the back-office. Countless times, small business owners have told us that they either dislike their bank, or simply never think about it. We want Relay to be a true value-add for small business owners. And we’re doing it in a few ways:

Convenience: Any time, anywhere, you should be able to do the banking you need to do and get the support you need to get. Opening accounts, issuing cards, making payments… we know these “small things” can be huge pains — so we’re making them easy, accessible and affordable.

Integrations: We’re really serious about building comprehensive integrations that truly automate the small-business back office. This includes having direct, reliable bank feeds into Xero and QuickBooks Online. We were also the first banking platform to integrate AP automation into banking workflows. With this funding, we’re going to meaningfully expand our portfolio of market-leading integrations.

Enriched, reliable data: We’re on a mission to build the world’s most comprehensive transaction data set. This means always knowing, at a glance, what each transaction in your account was for. Without clear financial data, cash flow visibility just isn’t possible.

Collaboration: With Relay, internal team members and external advisors (like accountants and bookkeepers) can seamlessly and safely access the parts of your banking required to do their jobs. This should be how banking works.

Personalized support: We hear time and again that the quality and care of our support team is a huge part of why business owners choose Relay. We are committed to continuing to offer fast, knowledgeable and personalized support as we grow.

This all adds up to a single mission: reducing the financial admin burden on small business owners, allowing them to spend less time in the weeds of their business, and more time focused on the growth of their business.

Building for business owners and their advisors

Growing businesses almost always rely on accountants and bookkeepers, whether as part of their internal team or by employing outside firms. These are crucial (often make-or-break) relationships and we want to make those relationships as solid and efficient as they can be.

During my four years at Hubdoc, I had the chance to get to know and deeply work with the accounting and bookkeeping community. They are a group of incredibly passionate, dedicated individuals who are 100% committed to helping their small-business clients succeed. Here at Relay, we believe that a strong relationship between business owners and advisors is essential to helping businesses succeed.

Accountants and bookkeepers are all too familiar with the time-sink of broken bank feeds, the hassle of trying to access client banking, and how challenging it is for their clients and themselves — business owners in their own right — to simply get the support and functionality they need from their traditional bank.

Not only does Relay’s permissioning model make it easy for business owners to collaborate with their advisors on banking, we’re making accounting and bookkeeping simpler — full stop. Today, we’re doing that with direct bank feeds into Xero and QuickBooks Online, a client portal where advisors can access multiple client accounts from their own login, and a clear audit trail that tracks every single transaction.

The relationship between advisors and business owners will continue to be central to our mission as we grow here at Relay.

What’s next

We wouldn’t be here if it wasn’t for our incredible team, who have pushed to get Relay where it is today. It’s my commitment to build a collaborative, high-trust, high-performing culture here at Relay. If this sounds like you, and you’re interested in helping scale a product with the potential to impact millions of employer businesses across the United States, we’ve got roles open on every team.

>> You can check out our job board here.

Last but not least, thank you again to our customers and partners for supporting us and going on this journey with us. There is so much more to come.

Onwards and upwards,

Yoseph West, Co-Founder & CEO @ Relay

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn more