If you’re a business owner in west Michigan, one of the more important long-term decisions you’ll make is where to do your business banking. In this guide, we compare Relay, an online banking platform, and Macatawa Bank, a traditional bank.

Traditional banks, like Macatawa Bank, offer both in-person and online services. They support both personal and business banking needs. Modern platforms like Relay provide a fully digital banking experience specifically for businesses. Let's take a closer look at what each institution brings to the table.

In this article:

What is Relay?

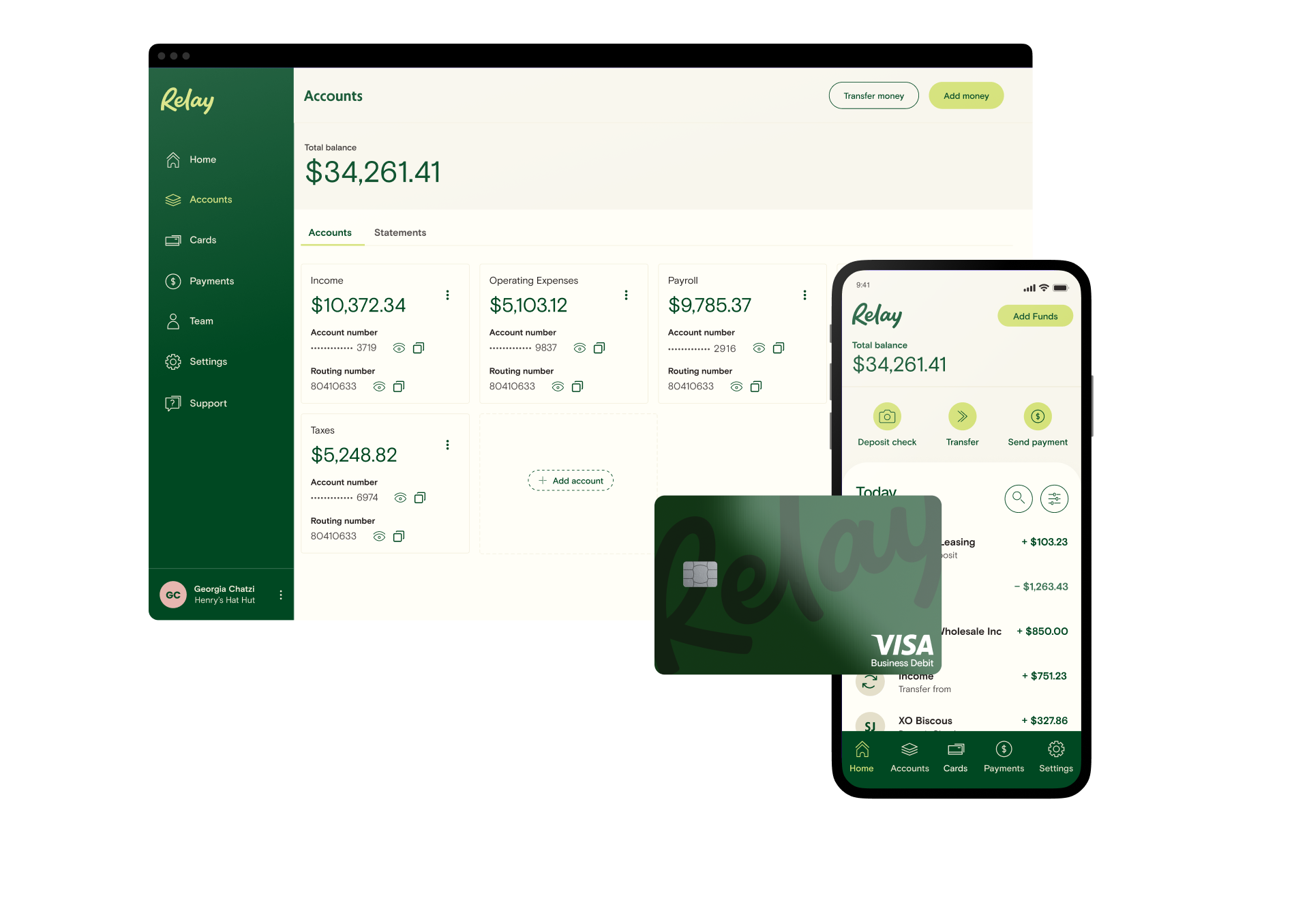

Relay is a modern online banking platform that helps small businesses manage their money and cash flow. Users can create up to 20 free checking accounts and handle multiple payments from one centralized place.

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn moreAs an online-only platform, Relay creates a seamless banking experience for its users. Small businesses also have the option to grow their money through savings accounts that earn between 1-3% APY.

What is Macatawa Bank?

Macatawa Bank is a community bank that serves West Michigan. Business accounts have access to checking and savings accounts, money orders, and loan products, among other services.

Macatawa Bank has 26 full-service branches located throughout Kent, Ottawa and Allegan counties. Customers can also utilize mobile banking.

Relay vs. Macatawa Bank Comparison Chart

Features/Services | Macatawa Bank | Relay |

Open Account Online | ✅ | ✅ |

Online Banking | ✅ Web, Apple iOs and Android Mobile Apps | ✅Web, Apple iOs and Android Mobile Apps |

Monthly Account Fees | Varies by account. (Ranging from $0 to $60) | $0 |

Minimum Opening Deposit | $50 | None |

Minimum Balance Requirement | Varies by account. (Ranging from $0 to $15,000) | None |

Overdraft Fees | $32 | $0 |

Money Movement | Insert fees here Wire Transfer: $30 domestic, $75 international ACH Payments: | Wire Transfer: $5 domestic, $10 international (Free with Relay Pro) ACH Payments: Free |

ATM Access | ATMs at each of the 26 locations | 55,000+ |

Branch Locations | 26 - throughout Kent, Ottawa, and Allegan counties | Online-only |

Interest-bearing accounts | ✅Varies by account | ✅1-3% APY on savings depending on balance |

Business Credit Cards | ✅ | ⛔️ |

Online Reviews |

Online and Mobile Banking

Relay Mobile and Online Banking

Relay users can manage their banking needs through the mobile app or a web-based option. Both platforms include user-friendly menus. When you manage money with Relay, you can access additional features such as receipt capture via mobile camera and virtual debit cards.

Macatawa Bank and Online Banking

Account owners can manage their banking needs online 24/7 by using the Macatawa Bank mobile app or a web-based portal.

Monthly Fees and Other Charges

Relay Fees

Through Relay, there are no monthly fees, overdraft fees, or minimum balances, freeing up more funds for account owners

Macatawa Bank Fees

Fees vary for businesses owners banking with Macatawa Bank based on which tier of account they have. Here are the monthly fees/minimum balances for their business accounts:

Checking:

Business Basic Checking: No monthly fee and no minimum balance requirement

Business Access Checking: Monthly fee of $7 (waived if minimum monthly balance is $2,500)

Business Access Plus Checking: Monthly fee of $15 (waived if minimum monthly balance is $10,000)

Business Advantage Checking: Monthly fee of $60 (waived if minimum monthly balance is $15,000)

Savings:

Business Money Market: Monthly fee of $10 (waived if daily minimum balance is $1,000)

Business Savings: Quarterly fee of $6 (waived if daily minimum balance is $100)

Accounts Payable

Relay Accounts Payable

Relay’s all-inclusive dashboard makes it easy for account owners to manage bill payments. It also automatically saves contact information for vendors. The dashboard integrates with Quickbooks Online and Xero.

With Relay Pro, Relay’s paid tier, additional features include same-day ACH and free outgoing wires. For people on your team, you can also set up multi-step approval rules for easier processing.

Macatawa Bank Accounts Payable

Macatawa Bank offers a variety of payment options. The Quick Pay option enables account owners to make one-time or recurring payments. ACH Disbursement Services can be set up to schedule payments. Online Bill Pay is also available.

Verdict: Which banking partner is right for your business?

Choosing the right banking partner is important for the success and growth of your business. Both Relay and Macatawa Bank offer unique features tailored to support business needs.

While Relay provides a digital-first approach with seamless integrations and no monthly fees, Macatawa Bank offers a variety of business checking account options and local community support in western Michigan.

To find the right fit for your business, consider your goals and the type of support you need. Then, choose the banking platform that aligns with your business plan. And if you're ready to sign up for Relay, you can !

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn more