In Atlanta and the state of Georgia, businesses must align with a bank that not only understands their needs, but offers services that foster growth. With so many community banking options available in Georgia, making the right choice can be daunting.

Relay and the Bank of Newington are two local banks with a commitment to fostering small businesses across the state of Georgia. Both offer competitive features, but which one is best for your business’s financial and banking needs?

In this article, we'll delve into a side-by-side comparison of Relay and Bank of Newington, two prominent players in the business banking arena, to help you discern which might be the best fit for your company.

In this article:

What is Relay?

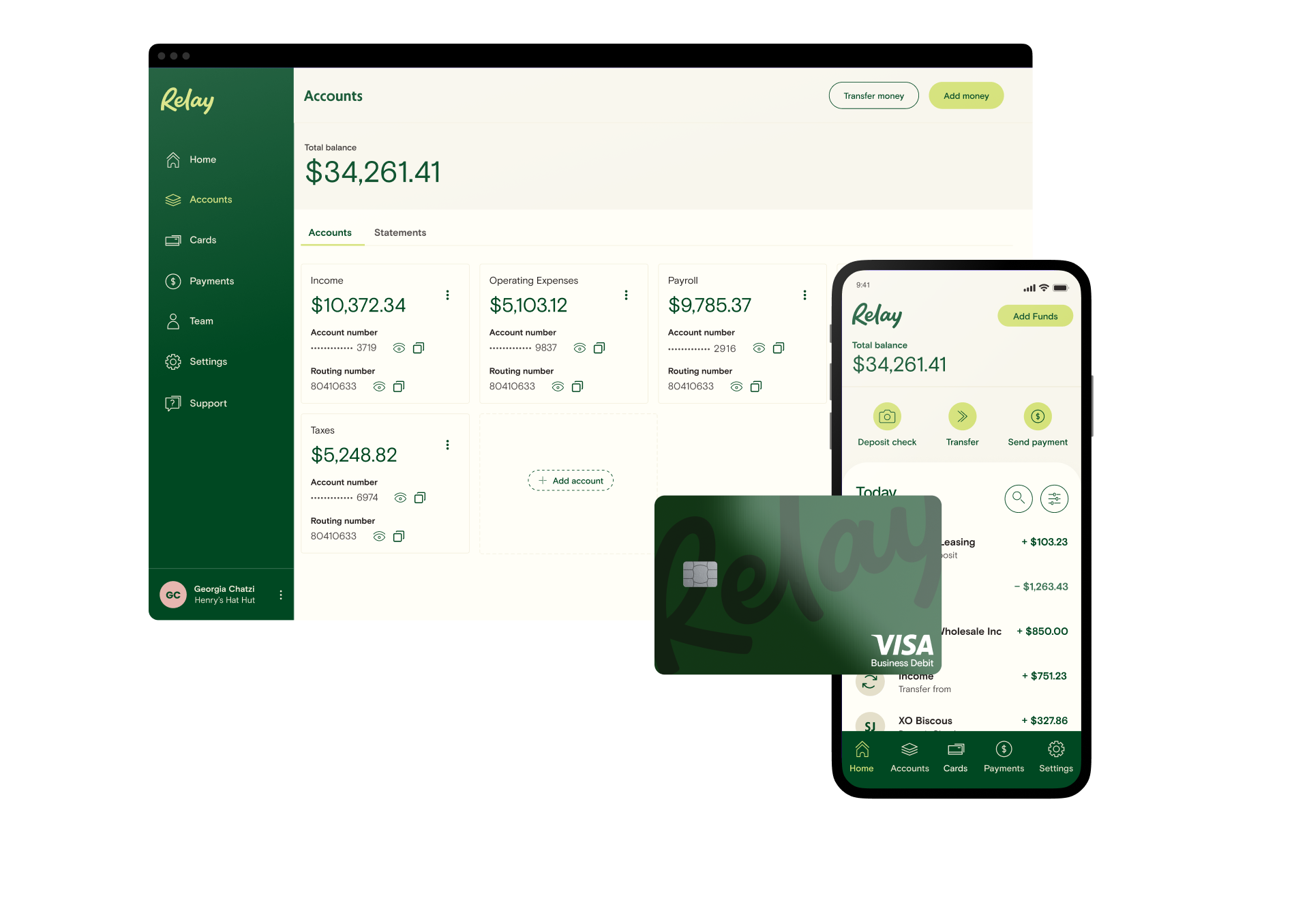

Relay is a modern banking platform designed for the needs of small to medium-sized businesses. With a digital-first approach, this platform offers a seamless banking experience. Relay integrates effortlessly with popular accounting tools like QuickBooks, Xero, and Gusto.

Relay also goes beyond the basics of business banking. Relay gives small business owners the ability to collect W9 forms from payees, adjust spending limits on physical and virtual debit cards, and facilitate percentage-based transfers between accounts.

What is Bank of Newington?

Georgia's Bank of Newington is a traditional banking institution that has been serving its community since 1919. They offer a range of services tailored for businesses, from basic checking accounts to more specialized interest-bearing options.

With a focus on local businesses, Bank of Newington provides personalized service, ensuring clients have the resources and support they need.

Relay vs. Bank of Newington Comparison Chart

Features/Services | Bank of Newington | Relay |

Open Account Online | ⛔️ | ✅ |

Online Banking | Web, Apple iOs and Android Mobile Apps ✅ | Web, Apple iOs and Android Mobile Apps ✅ |

Monthly Account Fees | $0 | $0 |

Minimum Balance Requirement | None | None |

Overdraft Fees | $0 | $0 |

Minimum Opening Deposit | None | None |

Branch Locations | 3 | Online-only |

Interest-bearing accounts | ✅ Varies by account | ✅ 1-3% APY depending on balance |

Business Credit Cards | ⛔️ | ⛔️ |

Online Reviews |

Online and Mobile Banking

Modern businesses perform their best with robust online and mobile banking capabilities. Relay offers a comprehensive online banking platform that's intuitive and user-friendly. Businesses can manage their finances, make transfers, and even integrate with accounting tools, all from the comfort of their devices.

Relay’s mobile banking app ensures that business owners have access to their accounts on the go, complete with mobile check deposits and real-time alerts. This digital-first approach ensures that businesses can operate efficiently, no matter where they are.

While Bank of Newington offers online banking services, they lean more towards the traditional side of banking. Their online platform allows businesses to manage their accounts, view transactions, and make transfers.

Bank of Newington’s mobile app, available on both Android and iOS, provides basic banking functionalities, ensuring that businesses can access their accounts while on the move. While they might not have the extensive digital features of newer banking platforms, they offer a reliable and straightforward online banking experience.

Monthly Fees and Other Charges

Relay believes in transparency and affordability. Relay doesn't burden businesses with hidden fees or exorbitant charges. With no monthly fees, businesses can allocate their resources where they matter most.

Relay offers features like no minimum balance requirements, ensuring that businesses, whether big or small, can benefit from our services without any financial strain.

Bank of Newington offers two primary business checking accounts: Free Business Checking and Business NOW Account.

The Free Business Checking comes with no monthly service charge, provided the account maintains a minimum balance of $1,000. The Business NOW Account has a monthly service fee of $7.50 but offers the advantage of earning interest.

Businesses should assess their banking needs and choose an account that aligns with their financial goals and requirements.

Business Savings

One of the standout features of Relay is the ability to earn interest on your business funds. Relay understands that every penny counts when it comes to business operations.

Relay offers interest-bearing accounts that allow businesses to grow their money while it sits in the bank. This feature is great for businesses looking to maximize their financial growth without taking on additional risks.

Bank of Newington offers the Business NOW Account, which is an interest-bearing checking account designed for businesses. This account not only provides the standard features of a business checking account but also allows businesses to earn interest on their balances. It's a great option for businesses that maintain a higher balance and want to earn some return on their funds.

Customer Support

Relay understands businesses may have questions or need assistance when it comes to banking, and we're here to help.

Relay offers multiple channels of support, including email and phone. Our dedicated team is trained to assist with any queries, ensuring that businesses have a smooth and hassle-free banking experience.

Businesses can reach out to the Bank of Newington through phone, email, or by visiting one of their three branch locations in Georgia. Their team handles queries and assists with anything business owners need.

While Bank of Newington might not offer the extensive digital support channels of newer banks, their personalized touch and commitment to their community make them a reliable banking partner.

The Verdict: Choosing the Best Bank for Your Business

Choosing the right banking partner is crucial for the success of your business. While Bank of Newington offers a community-centric approach, modern platforms like Relay provide a suite of digital tools designed with businesses in mind.

With Relay, businesses can benefit from interest-bearing savings accounts, robust customer support, and seamless integrations. As you evaluate your banking options, consider what features and services align best with your business goals and operational needs.

Ultimately, to find the right fit for your business, consider your goals and the type of support you need. Then, choose the banking platform that aligns with your business plan. And if you're ready to sign up for Relay, you can get started entirely online here!

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn more