You might be wondering where you stand on your small business’ meals and entertainment tax deductions in 2023 and beyond—especially if you’re unfamiliar with tax best practices. 😵💫

There has been lots of back and forth with tax deduction requirements between the Tax Cuts and Jobs Act (TCJA) of 2018 and the Consolidated Appropriations Act (CAA) of 2021. And you just want to make sure that as you’re paying for all these different meal and entertainment expenses, you’re not leaving any deductible business expense on the table.

In this blog, we’ll cover the following to help you maximize your tax deductions:

Overview: Meals and entertainment deductions for 2023 onwards

Record keeping 101: stay on top of your meals and entertainment deductions 🧾

It's time to get tax-ready. Let's dive in!

➡️ Disclaimer: The content in this article has been reviewed by a licensed Certified Public Accountant (CPA). However, before writing off any expenses on your tax return this year, it’s always a good idea to consult with a tax professional who can review your unique situation.

Overview: Meals and entertainment deductions for 2023 onwards

Business tax deductions can be confusing. That's why we put together this quick overview to help you understand which meals (and what kind of entertainment) are able to be written-off in your business tax return:

Type of expenses | Percent deduction |

Food for company parties | 100% deductible |

Client meals | 50% deductible (100% for tax years 2021 and 2022) |

Food for charitable causes | 100% deductible |

Meals for in-office meetings | 50% deductible |

Snacks for employees | 50% deductible |

Renting out an entertainment facility | 0% deductible |

Membership club dues for an entertainment facility | 0% deductible |

Entertaining clients | 0% deductible |

Now let's take a closer look at these different types of meals and entertainment tax deductions.

Fully deductible expenses: rules and examples

Whether you’re newly self-employed or an seasoned small business owner, you won’t want to forget any fully deductible expenses on your tax return this year. 🎁

You get fully covered meal deductions if you can reasonably prove that the food was going towards at least half your employees. For example, if you throw a company holiday party (or a team-wide summer picnic) or have a business meeting where you provide lunch for your employees, the meal expenses would be 100% deductible.

You can also claim a 100% meal deduction when you’re dealing with the public. Refreshments or snacks for the public can be fully deductible if you can reasonably estimate they were eaten by at least 50% of clients. This includes restaurants and cafés offering sidewalk samples. 🍬

Donating food to qualifying nonprofit causes can be fully deductible as a charitable contribution.

Keep in mind, that there are important rules to follow to ensure those credit card charges are fully deductible:

Meal expenses can only be deducted when the taxpayer (i.e. you) is present. 💁♀️

Any food-related expense bought at a grocery or convenience store is nondeductible 🛍️

Unnecessarily extravagant food items cannot be deducted. 🍷

50% deductible expenses: rules and example

There are a lot more 50% deductible expenses available to help you reduce your tax liability, compared to the fully deductible expenses discussed above. 💲

For example, any meal with a client is 50% deductible. But, If you invite friends or relatives, they can’t be included in the business meal deduction. This is one of those tricky moments where you’re going to have to separate your business taxes from your personal taxes because you can still write off the business meal expenses that you paid for your employees, clients, or yourself.

Other things that would be 50% deductible are office snacks for employees as well as the cost of meals for employees who are working through meal time (like emergency workers who might man a hotline during dinner hours). 🍜

And while you can’t get a tax deduction for entertainment events, if you can separate your receipts for any food in a business entertainment setting, you can claim that as a 50% deductible.

Expenses that aren’t deductible: rules and examples

In 2023 and beyond, the general rule of thumb is that no entertainment expense is going to be deductible. That means there’s going to be no wiggle room around writing off the cost of a ticket to take your favorite client to any sporting event or concert. 🫢

Other examples of non-covered entertainment costs include the following:

Renting out an entertainment facility

Membership dues for an entertainment facility (ex: country club)

And if you get food as part of one bulk cost at an entertainment venue and can’t separate the cost of it, it won’t be deductible.

Record keeping 101: Stay on top of your meals and entertainment deductions

To take advantage of any of the deductions above, keep track of all meals regardless of cost and keep the receipts for any meal over $75. You’ll want to keep track of the following details in your account book or binder:

Date 📅

Business purpose 💼

The names of everyone at the meal (and why they’re there)

Where the meal is located 🌐

Total cost 💲

If you can’t supply this information, you’re at risk of negating your deduction. Keeping your receipts organized can be tricky, but trust us—the tax savings will be worth it.

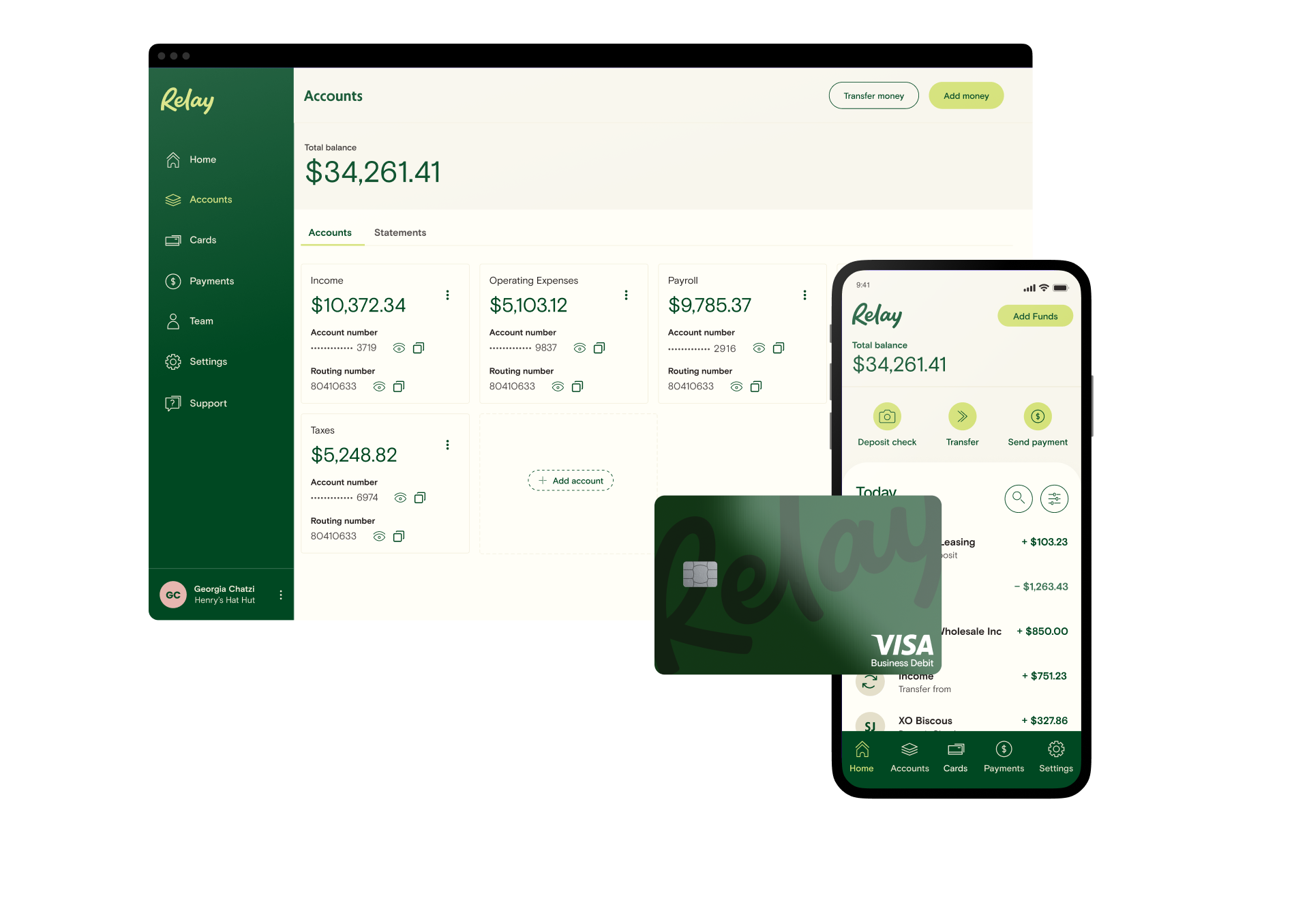

The good news is that Relay (that’s us!) can help. Relay is an online banking and money management platform designed for small businesses. With Relay, you can open up to 20 individual business checking accounts and issue 50 virtual or physical debit cards.

That means you won’t have to comb through one messy bank statement to remember which meals you paid for—instead, you can dedicate one debit card or bank account to meals with business associates, another for travel expenses, and yet another for special events (like that company picnic you’ve been planning).

Then, Relay will help you stay tax-ready with our new receipt management feature. We’ll send you (and your team members) reminders to upload your receipts—and then after you upload the receipt, we’ll automatically attach it the matching transaction.

Say goodbye to that overflowing desk full of receipts and hello to tax savings. 😎 Sign up for Relay today in as little as ten minutes here.

The bottom line on meals and entertainment deductions

From business meals to entertainment expenses, you don’t want to pull the wool over the IRS’s eyes. But, you also don’t want to misreport and miss any potential cash this tax year. 😬

That’s why the best thing to do here is stay on top of all your information and don’t lose your receipts to get a tax return that’ll make you happy. And while you shouldn’t give up on entertaining your clients, don’t expect to get a tax deduction from it anymore.

Stay on the money with Relay

Relay is an online banking and money management platform that lets small business owners open multiple no-fee business checking and savings accounts.

If you're a small business owner, you won't want to miss our On the Money newsletter. At the start of each month, we'll answer questions like...

How close are AI robots to doing your corporate tax filings? 🤖

What's the US central bank doing to make payments lightning-fast? ⚡️

And is Taylor Swift's Eras Tour saving the economy? 🪩

Subscribe now to find out about all these topics and more!

Subscribe to On The Money

Monthly newsletter from Relay, covering the latest news for your small business

Subscribe