As a small business owner in Michigan, you have a lot of options when it comes to business banking. To help you make a decision, we’ve compared different business banking providers and their bank accounts. 🏦

We looked at national banks, regional banks, and online banking platforms to find the best banks for businesses based in Michigan. We excluded credit unions in this list.

Every financial institution we compared offers FDIC insurance. They also offer at least a basic business checking account. Additionally, each bank has online or in-person access (and sometimes both). Most banks listed offer other financial services like lending services, money market accounts, payroll services, and credit cards. 💳

The 11 best banks for small businesses in Michigan are...

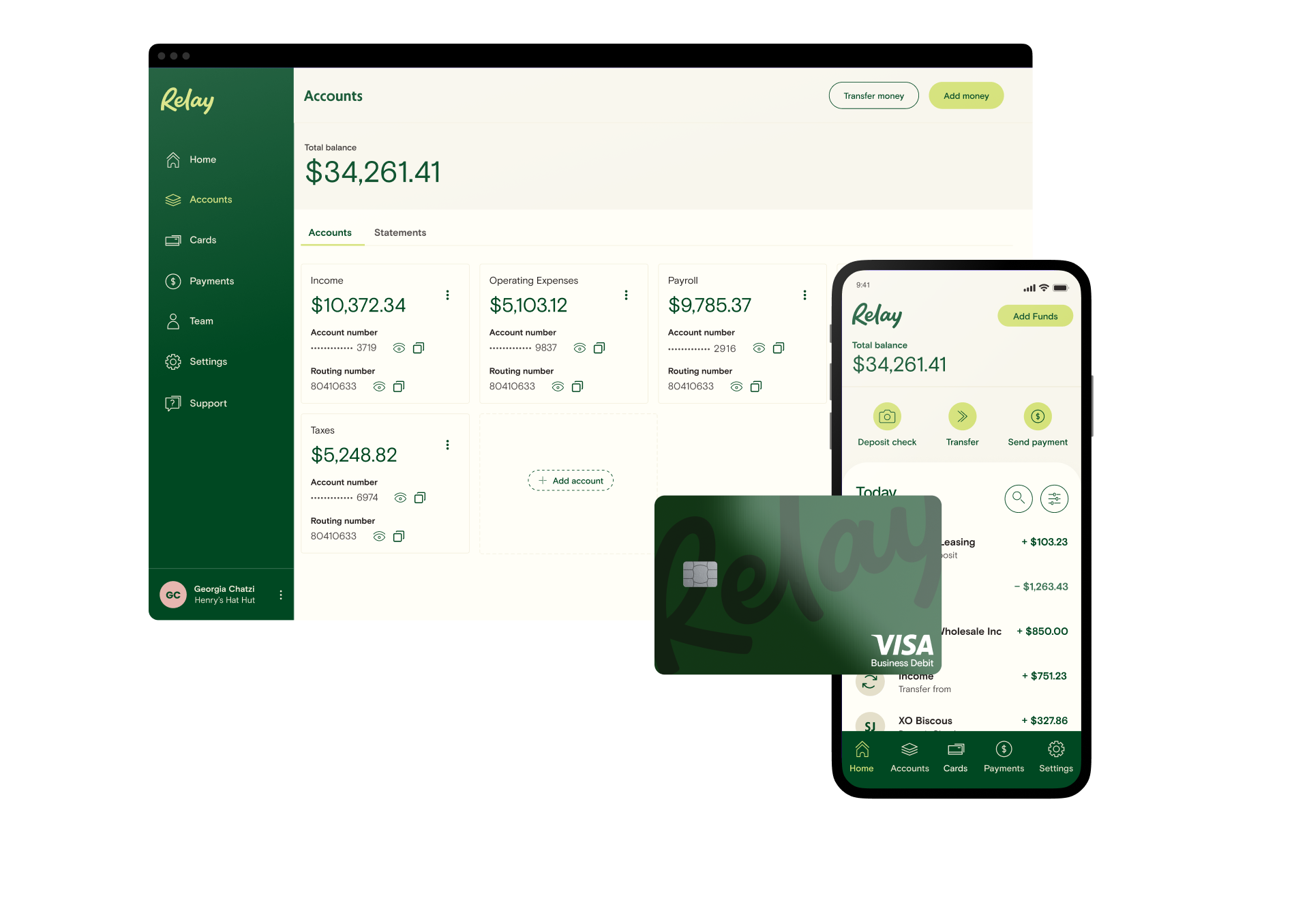

Relay: Best for online cash flow management

🏆 Verdict: Relay is the top online business banking platform for small business owners who want to simplify cash flow management. With the ability to open 20 individual checking accounts, Relay is also a great choice for those looking for Profit First money management. 🎖

Relay is an online banking and money management platform built for small businesses and freelancers. Relay’s bank accounts have no monthly fees (including overdraft fees and service fees) and no minimum balances. There are also no opening balance requirements.

You can open up to 20 individual checking accounts and 2 savings accounts with Relay for free. You can also issue up to 50 physical or virtual Visa® debit cards. Plus, automatically transfer idle funds into your savings accounts to earn between 1-3% APY(1) interest rates on that extra cash. 💸

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn moreRelay also offers Relay Pro, which comes with advanced money management features. Relay Pro provides same-day ACH transfers, free wire transfers, and seamless accounts payable integration. Participating accounting platforms include Quickbooks, Xero, and Gusto.

Banking features:

Banking Feature | Details |

Account Fees | $0 |

Minimum Balances | $0 |

Checking Accounts | Up to 20 |

Savings Accounts | None |

Money Movement | Unlimited transactions Free ACH and check deposits Domestic outgoing wires: $5 International outgoing wires: $10 Or with Relay Pro (for $30/month) you get unlimited outgoing domestic and international wires Same-day ACH transfers |

Cards | Up to 50 free virtual or physical debit card Mastercards |

Financing | None available |

Customer Service | Dedicated customer service via email, chat, or phone |

4.5/5 |

Chase: Best for a large branch network

🏆 Verdict: Chase is the best choice if you’re looking for a traditional bank with reliable branch access. Like its competitors Bank of America and Capital One, it has hundreds of branch locations and thousands of Chase ATMs nationwide.

It also offers more than just business bank accounts; you can choose from a wide selection of other financial products and services.

Chase Bank is one of the largest traditional U.S. banks. It’s a major player in both personal and business banking. Chase has many banking services and products. These include a broad selection of credit cards, perks, cashback options, and a mobile app that’s great for mobile banking. 📱

Banking features:

Banking Feature | Details |

Account Fees | $15 monthly fee, $2000 minimum daily balance to waive |

Minimum Balances | Balances vary, can be as low as $2000 |

Checking Accounts | 1 checking account |

Savings Accounts | 1 savings account |

Money Movement | Unlimited debit card purchases and no ATM fees ACH: $25 per month for up to 25 payments Checks: $4 check fee Domestic outgoing wires: $25 to $35 International outgoing wires: $40 |

Cards | Debit cards and credit cards available |

Financing | Various financing options available, including lines of credit, small business loans, and commercial real estate financing |

Customer Service | Branch or online customer service via phone or email |

TrustPilot Score |

United Bank of Michigan: Best for a community-oriented bank

🏆 Verdict: With a high focus on community initiatives and relatively low monthly maintenance fees and minimum balances, United Bank of Michigan is a great choice for Michigan small business owners looking to support their community. 🔨

United Bank of Michigan has existed for over 135 years. It has a dozen branches across Michigan and strongly believes in community banking. United Bank of Michigan offers options for lenders, personal loans, and savings accounts. 💵

Banking features:

Banking Feature | Details |

Account Fees | $7-$50 monthly fee depending on plan; $100 minimum opening deposit |

Minimum Balances | $250-$15,000 depending on plan |

Checking Accounts | 1 checking account |

Savings Accounts | 1 high-yield savings account |

Money Movement | Mobile check deposit available Offers ACH transfers and online wire transfers (subject to approval) |

Cards | 1 instant-issue debit card (select locations) with mobile pay capabilities |

Financing | Various financing options available, including credit cards and loans for refinancing, renovation/expansion, and new opportunities/equipment |

Customer Service | Customer service in-person at branches, by mail, by phone, or by online chat |

Google Reviews Score | 3.6/5 |

Bank of Ann Arbor: Best for a traditional banking experience

🏆 Verdict: Bank of Ann Arbor is a traditional-style bank. It has lines of credit, direct deposit options, wealth management services, and more. Bank of Ann Arbor is a good choice for small businesses looking for a more traditional type of banking. 🪙

As a community bank in Michigan, the Bank of Ann Arbor makes it a priority to be fair-minded, open to change, and sustainable. It has offices and ATMs around Michigan and offers home loans and personal accounts in addition to business accounts.

Banking features:

Banking Feature | Details |

Account Fees | $10 monthly maintenance fee without minimum balance; $100 minimum opening deposit |

Minimum Balances | $1,000 (Small Business Checking plan) |

Checking Accounts | 1 checking account |

Savings Accounts | 1 health savings account |

Money Movement | Free online bill pay via online banking Provides wire transfers Up to 6 free transfers per month between Bank of Ann Arbor accounts |

Cards | 1 card |

Financing | Offers business lines of credit, business term loans, and letters of credit |

Customer Service | Customer service in-person at offices or via phone |

Google Reviews Score | 2.9/5 |

The State Bank: Best for those looking to borrow

🏆 Verdict: With a rich history of lending and great scores across the board, The State Bank is best for small businesses that need to open a line of credit. Small Business Administration (SBA) loans offer benefits for borrowers. The State Bank is a preferred member of the SBA.

As the #1 Michigan-based Community Bank SBA lender four years in a row, The State Bank has a mission of “helping you reach your better state”. Having existed since 1898 in the Michigan community, The State Bank has a history of community orientation and innovation. 📈

Banking features:

Banking Feature | Details |

Account Fees | $3-$20 depending on plan |

Minimum Balances | $5,000+ for larger two plans |

Checking Accounts | 1 checking account |

Savings Accounts | 1 savings account (three different plans) |

Money Movement | Free online banking and bill payment Includes all business checking plans |

Cards | 1 debit card |

Financing | Offers small business term loans and is a Preferred Small Business Administration (SBA) lender |

Customer Service | Has in-person branches and support with online chat or by phone |

Google Reviews Score | 3.9/5 |

Lake Osceola State Bank: Best for those ready to switch

🏆 Verdict: Lake Osceola State Bank has staff dedicated to helping you make the switch. Their excellent customer service skills give them top points from a bank-changing perspective. Having a Business Switch Concierge will make what once was a hassle an easy task!

Over 100 years of banking history have made Lake Osceola State Bank a staple bank in the Michigan community. The bank has a convenient, modern, and innovative approach to banking. Lake Osceola State Bank supports the local community in addition to its customers. 🤝

Banking features:

Banking Feature | Details |

Account Fees | $0 with Business eChecking plan |

Minimum Balances | $0 with Business eChecking plan ($100 deposit to open) |

Checking Accounts | 1 checking account |

Savings Accounts | 1 business savings account |

Money Movement | Online banking and bill pay Free with Business eChecking plan Available online cash management services |

Cards | 1 debit card |

Financing | Has business term loans, SBA loans, and business lines of credit |

Customer Service | Can be contacted in-person at a branch or by phone |

Google Reviews Score | 3.8/5 |

Nicolet National Bank: Best for a growing small business

🏆 Verdict: Nicolet National Bank has over half a dozen types of business checking solutions based on business type and size. It’s a perfect option for businesses looking to grow alongside a bank. You can start with Small Business Checking and graduate to Corporate Checking. 🧑🎓

You can also specify your business’s bank account with Professional Services Checking (for Medical, Dental, Legal, etc professions), Non-Profit Checking, and Parish Checking.

Nicolet National Bank’s goal is to serve the “three circles”: customers, shareholders, and employees. The bank has a community focus through the Nicolet Foundation and a Diversity, Equity, Inclusion (DEI), and Belonging Policy. This bank focuses on keeping people “real”. 💰

Banking features:

Banking Feature | Details |

Account Fees | $10 (with Small Business Checking) |

Minimum Balances | $250 average to waive monthly fees; $100 minimum deposit to open (with Small Business Checking) |

Checking Accounts | 1 checking account |

Savings Accounts | Several types offered, including savings accounts, Certificate of Deposit (CD) accounts, and Business Money Market accounts |

Money Movement | Online and mobile banking for ease of access Check deposits via app Account charge monitoring via app |

Cards | 1 debit card |

Financing | Lending services offered? |

Customer Service | Contact available via email, phone, and in-person at branches |

Google Reviews Score | 3.0/5 |

Huntington National Bank: Best for one-and-all services

🏆 Verdict: Huntington National Bank is large and offers many financial services. It would be the best choice for someone looking to do all their banking with just one company.

This bank is one of the largest banks in Michigan. Huntington National Bank has made a name for itself with its award-winning app. Huntington is #1 in Customer Satisfaction with Mobile Banking Apps among Regional Banks for the 5th year in a row. 🏆

Huntington National Bank has a history of looking out for people and community involvement. The bank has been around since 1866 and has more than 1,000 branches in 11 states.

Banking features:

Banking Feature | Details |

Account Fees | $0 (with Business Checking 100) |

Minimum Balances | $0 (with Business Checking 100) |

Checking Accounts | 1 checking account (several types available) |

Savings Accounts | 1 savings account |

Money Movement | 24-Hour Grace feature for deposits Helps avoid overdraft or return fees Zelle transactions Incoming wires from $18-$25 Outgoing wires from $50-$80 |

Cards | 1 debit card |

Financing | Offers real estate loans, dental and veterinary loans, SBA-Guaranteed business loans, and business lines of credit |

Customer Service | By phone, online chat, or in-person at various branches |

Google Reviews Score | 2.9/5 |

Macatawa Bank: Best for those who want to keep it local

🏆 Verdict: Macatawa Bank focuses on Michigan locations. It’s great for small businesses who want a bank that is well-familiarized with Michigan as a community and business center.

With a home in Michigan, Macatawa Bank makes an effort to remain loyal to its community roots. The bank has 26 full-service branches located throughout West Michigan. It offers mobile banking, lending, and auto loans, among many other services. 🚗

Banking features:

Banking Feature | Details |

Account Fees | $0 (Business Basic Checking) |

Minimum Balances | $0 (Business Basic Checking); $50 opening deposit |

Checking Accounts | 1 checking account |

Savings Accounts | 1 savings account (Money Market, Business Savings, and Business Term Certificates of Deposit) |

Money Movement | Free bill pay and online banking Same Day ACH available |

Cards | Multiple debit cards for authorized employees |

Financing | Lines of credit, term loans, SBA financing, commercial mortgages, and more are offered |

Customer Service | Contact by phone or in-person at a branch, or use the online chat feature |

TrustPilot Score | 3.2/5 |

ChoiceOne Bank: Best for keeping it simple

🏆 Verdict: If you’re a small business owner looking for a simple, clean-cut, and no-nonsense bank, ChoiceOne Bank would be a great pick. It streamlines the business banking process, without all the bells and whistles.

ChoiceOne Bank’s goal is to be the best bank in Michigan. They have committed to reaching that goal year after year. They’re dedicated to giving back to the community and have initiatives including a Scholarship Program to reach their goal. ✏️

Banking features:

Banking Feature | Details |

Account Fees | $0 (for Small Business Checking) |

Minimum Balances | $0 (for Small Business Checking); $100 opening deposit |

Checking Accounts | 1 checking account |

Savings Accounts | 1 savings account |

Money Movement | Check and deposit support ACH support available Also supports point of sale (POS) transactions |

Cards | 1 debit card |

Financing | Offers SBA loans, term loans, working capital lines of credit, and more |

Customer Service | Has customer service phone lines in both English and Spanish in addition to in-person branch locations |

Google Reviews Score | 3.5/5 |

Central Savings Bank: Best for owners who want more support

🏆 Verdict: Central Savings Bank is an expert in customer service. It has several avenues of communication open with its customers at all times. This bank would be a great fit for a small business owner who wants to have a voice or say in their bank’s development.

There’s a reason that Central Savings Bank’s CEOs have decades of service under their belt! The community-involved bank has operated for over 100 years and now has 9 branch locations situated around Michigan. 📗

Banking features:

Banking Feature | Details |

Account Fees | $4 (Standard Checking Account) |

Minimum Balances | $2,000 to waive fees (Standard Checking Account); $100 minimum opening deposit |

Checking Accounts | 1 checking account |

Savings Accounts | Number of accounts offered |

Money Movement | Always view your account with Internet Banking Bill pay offered |

Cards | 1 debit card |

Financing | Offers some commercial loans |

Customer Service | Contact via phone, email, comment form, or in-person at a branch; extensive FAQ section also available |

Google Reviews Score | 4.0/5 |

Final verdict: What’s the best bank for small businesses in Michigan?

After a thorough review of the top banks for small businesses in Michigan, it’s clear that each bank offers unique benefits and features. Which one is the best overall?

While each small business has different needs and preferences, Relay is a great option for convenient digital banking without pesky fees! 💚

The best part about Relay is that you can apply for an account in minutes online, without having to make the trip to an in-person branch.

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn moreWant to explore more options for your business bank account? Compare Relay with traditional national banks like , , and .