Running a small business means juggling a ton of tasks, with one of the most important being managing your business expenses. Getting your expenses right isn't just about staying organized; it's crucial for keeping your finances straight, making smart decisions, and staying on the right side of tax laws.

That’s why we’re to help small business owners (like you!) navigate the nitty-gritty of business expense categories. In this article, we’ll cover:

What are business expense categories?

Business expense categories are a method of organization that allows business owners to easily find any necessary spending documentation. With a virtual filing cabinet at the ready, any small business owner can own the next tax season. 💪

You can divide business expenses into two major types: operating expenses and non-operating expenses. Some of these expenses may also be tax-deductible.

Operating expenses

Operating expenses (commonly referred to as OpEx) are the essential, unavoidable costs of doing business. 💼

Take, for example, a self-employed dress designer. The fabric they need to buy to design dresses is core to their professional services. 👗

That one might be a no-brainer, but not all operating expenses are that obvious.

Let’s say this dress designer is frequently having to travel to their clients around the state to provide dress alterations. The cost of gas to travel to those appointments is an operating expense because it’s required to keep business going as usual. 🚗

And maybe their business is doing so well that they can move out of their garage office and start renting an office space. The rent for that space would also be an OpEx.

Non-operating expenses

Non-operating expenses (or NOPEX) are costs you might rack up that aren’t directly tied to your business operations. 🚫

For example, let’s say that the same dress designer got a small business loan to source and fabricate matching purses. Every month, they pay interest on that loan. That interest isn’t at the heart of their fashion operation, and therefore, is a non-operating expense.

Other common examples of non-operating expenses are:

Income tax

Asset depreciation

Lawsuit fees

Investment losses

Tax-deductible business expenses

Tax-deductible business expenses (or tax write-offs) are expenses that you can record and deduct from your taxable income. As a small business owner, you might want to start looking into these obvious—and not-so-obvious!—tax write-offs. 🧠

To get a tax write-off, the IRS says your expense must be “ordinary” and “necessary” to your business. It has to be a common cost in your line of work that benefits your business. In other words, you can’t expect reimbursement for personal expenses.

For example, most hair salon owners have to buy tools and supplies, like special scissors, for business use. These are an ordinary and necessary cost to perform their service. Some salon owners also provide client refreshments, which they can deduct since this service enhances the salon experience and therefore can bring in more profit. This means that the next glass of wine you accept from your hairstylist is part of their boss’s next tax deduction. 🍷

25 of the most common business expense categories for small businesses

But what if you want to organize your business spending beyond the categories mentioned above? Well, there are all sorts of different ways to divvy up your expense categories.

Here are 25 of the most common business expense categories small businesses run into. 💻 You can use these expense categories to keep your spending organized in your budgeting software, accounting software, and beyond.

1. Startup expenses

Startup costs add up, fast. For example, LLC filing fees can get up to $520 if you live in Massachusetts. And that’s not even counting all the other license or permit fees you might run into—or costs like business planning software. 💿

Setting these fees aside in an easy place to refer back to can paint a clearer picture of your expenditures.

2. Bank fees

It feels like you’re paying extra for just about everything these days, even for your business checking account. When you get these fees, immediately file them into your bank fee expense category. Eventually, you might just be able to score a tax credit. 🏦

Other examples of bank fees that you can rack up are cash deposit fees, ATM fees, excess transaction fees, and overdraft fees.

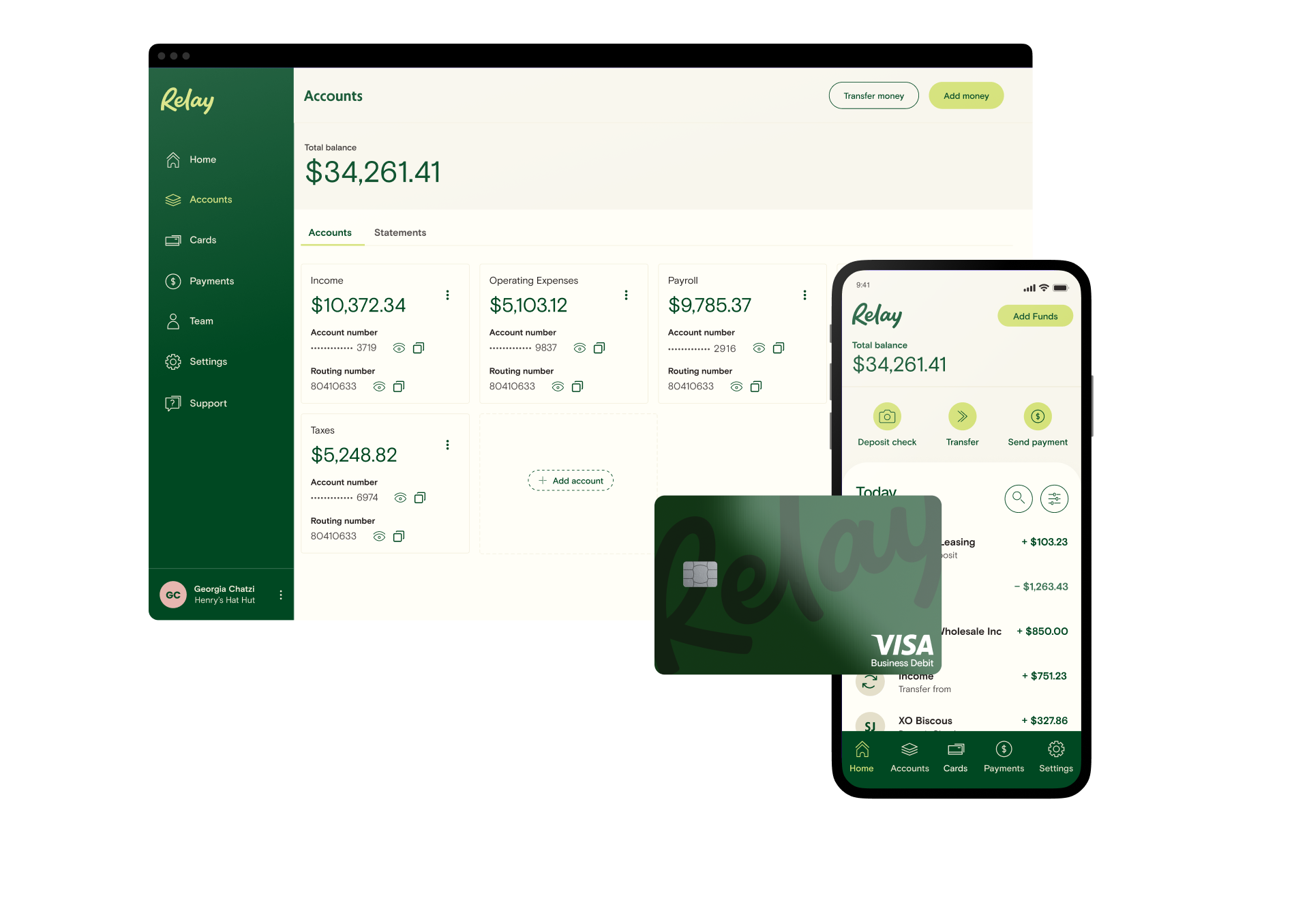

If you’re looking for a no-fee business banking platform, you might want to consider Relay (that’s us!). Relay is an online business banking and money management platform designed for small businesses like yours.

The best part? You can open multiple business checking and savings accounts to keep your money organized—without worrying about monthly maintenance fees, overdraft fees, or minimum opening deposits. 🙌 You can apply for a Relay account entirely online here.

3. Credit and collection fees

After opening a business line of credit, you might run into credit and collection fees. These are fees that might accumulate when paying back your debt—for example, late fees or expenses a collection agency might pay to recover unpaid money. These are common for small business owners, but that doesn't make them any harder to swallow. 💳

One way to stay on top of these payments is simply to log them all. That way you can also avoid the cost of collections on your business credit cards.

4. Internet-related fees

A common recurring cost most small businesses face is Wi-Fi! Who in the modern age can live without it? Website hosting fees are similar—you probably need a website to keep your business afloat.

Keep track of these fees to always pay them on time and avoid the chaos of waking up without Wi-Fi one day. And (hopefully!) to get a higher tax refund. 😉

5. Membership & subscription fees

Memberships to affiliate groups and subscriptions to business-related publications are eligible for tax deductions. 💥

While these memberships are not cheap, many consider them a worthy investment. For example, a subscription to the SD Times can help software developers stay on top of their game, or membership to the National Society of Accountants (or the NSA) can provide a valuable platform for networking.

6. Software fees

Finding the right software can take forever sometimes, and that means you’re always paying for some new license or subscription. Whether it's accounting software or payroll software, create an expense category to track how much you can write off your tax filing at the end of the year. 💾

7. Shipping costs

If you’re in the business of selling material goods, you have to know how much shipping is costing you. How else are you going to maximize your profits? 📤

Between packaging and the actual postal costs, this can significantly affect your pricing packages. Track these expenditures carefully so you know how much to charge customers in the future.

8. Insurance

Not only will business insurance or health insurance help you sleep better at night, but you can usually write off your insurance premiums by the end of the tax year. That’s called a win-win. 🥳

Bonus: The premiums you pay for liability insurance and life insurance are also write-offs. 🙌

9. Inventory-related buys

A quintessential example of an operating expense is the cost of raw materials. And because it’s such a core operating expense, you’re probably clicking add to cart a lot. 🛍️

Avoid going overboard by reviewing your inventory expenses regularly.

10. Meal and entertainment expenses

We often wine, dine, and delight in any line of work. 🍽️ That’s why the IRS offers a meal and entertainment dedication for businesses—but this one can get complicated fast, so make sure you talk to your accountant before writing just anything off.

It’s also especially important to keep receipts for this type of business expense. If you feel overwhelmed by a drawer full of paper receipts, you can always try a receipt-scanning app.

Or, you can use Relay—our online banking platform comes with integrated receipt management so you can easily digitize, store, and manage all your receipts.

11. Office supplies

This is another classic example of a core business expense. 🖇️

Office supplies range from your printer down to your very last staple. Tracking office expenses can help you set up a schedule to know when to replenish your stock and keep your spending under control.

12. Payroll expenses

Payroll expenses are difficult to manage—there’s no question about that. Between the salary you pay employees or even yourself, accounting for all these cash movements is key to a successful business. 🔑

13. Research & Development

Researching and developing new products, services, or packages helps you stay competitive. Regardless, you get no tax write-off for them following a 2022 tax law revision. 😳So, plan accordingly.

14. Taxes

You’re paying lots of taxes. Payroll taxes. State taxes. Maybe even real estate taxes. But, these expenses don’t have to be sunken costs. Any taxes paid to your state or your local government can be claimed as a business deduction.

That’s why it’s so important to include taxes as a bookkeeping category. 💸

15. Business travel

Any travel expenses you incur for business purposes are considered operating expenses. For example, you can save on any flights or vehicle expenses during your business trip. 🛫

16. Utilities

If you have a home office or office space, you can deduct the necessary utilities for your business. That’s right—we’re talking the whole gambit—water, electricity, and gas. ⛽

17. Employee benefits

You might be paying for certain employee benefits like health insurance or a gym membership. Good news—the premium you pay is tax-deductible, so go chase that write-off. 🏃

18. Advertising/marketing campaigns

Any campaigns you run are deductible business expenses because they can help grow your customer base. So, if that’s not a sign to get started on the next big ad campaign to hit social media, I don’t know what is. 📢

19. Charitable contributions

Being good pays off — literally. You get write-offs for any qualified donation. In fact, according to the IRS, a company can deduct up to 25% of its taxable income. 🧮

20. Retirement contributions

Moving funds to a retirement account (like your classic 401K) can lower your taxable income. Note how much you’re contributing to your retirement plans to make sure that you’re never short of cash on hand. 🧓

21. Client gifts

Client gifts are a common way to build that necessary relationship with your audience. Did you know you can deduct up to $25 a gift, according to the IRS? 🎁

Keep track of how much each gift costs and how much you might be saving after that deduction.

22. Rent / real estate taxes

The cost of rent or property taxes for your home office can’t necessarily be written off as an expense. However, these are high ticket costs. Staying on top of them is critical to your financial success. 🏡

23. Mortgage interest

If you took out a mortgage related to your business (let’s say you had a home office), then the interest you pay on it could be tax deductible. As this is a frequently recurring payment, make sure you’re claiming what you can here. 🏘️

24. Depreciation

Depreciation isn’t always good news because it means the value of your asset has gone down. But, you can get a deduction when tax time comes around. Plus, tracking the rate of depreciation gives you a clearer view of your financial profile.

25. Investments

While you might not be able to write off your whole investment, you can usually write off the interest you accrue on it. And if you’re in moderate to bad debt, this can make a real difference. 💫

How to categorize expenses

First things first, which receipts do you want to keep for your business expenses?

The IRS recommends keeping all records of business expenses over $75 that you stumble across—even for things like canceled checks. 💸

That means holding onto:

Gross receipts for anything that shows income flow into your business

Purchase receipts for items you bought and resold to customers

Expense receipts for business-related expenditures, like business cards

Deduction-eligible expense receipts for anything you elect to deduct, like transportation expenses

Proof of assets, whether it be a receipt, title, or any other sort of paperwork, for property bought for your business, like a car.

And make sure that if the receipts don’t have the following information, you have the following written down somewhere:

Date

Place

Category

Business purpose

Cost

💡Want to learn more about which receipts to keep, and how to organize them? Check out our ultimate guide to managing receipts here.

The bottom line: Make categorizing expenses easier with Relay

You didn’t get into the business to categorize your expenses and receipts. We get it. We’ve been there. That’s why we built a banking platform specifically for small business owners, including an easy-to-use receipt management tool specifically for small businesses that don’t have extra cash or hands on deck.

With the right tools and strategies, you can make the whole process a breeze, freeing you up to concentrate on what you’re best at—taking your business to new heights. 🦸

Receipts + business banking = ♥️

Ready to centralize your receipt workflow in Relay, and put an end to the month-end reconciliation scramble once and for all? Apply for a Relay account entirely online here.

If you have a Relay account, click here to learn how to set up your own receipt capture policy, or head to the Settings tab from your Relay account to get started.

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn more