The payroll onboarding process is all about getting new team members set up in the company's payroll system. Usually, someone from the human resources department or an office manager gathers the required info and documents from the new hire.

Then, they get them set up in the system so payroll processing is good to go, ensuring that employees get paid the right amount on time. Whether you’re hiring your first employee or you’re a seasoned payroll expert, we’re here to help you simplify the process. 🙌

In this article:

How to set up effective payroll onboarding processes

Making sure the payroll onboarding is effective is crucial. It helps keep records accurate, legal requirements in check, and makes sure the new team member has a smooth start. It also helps the company make a good first impression on the new hires and creates a positive onboarding experience. Plus, it cuts down on the admin work in the long term and keeps the whole organization running smoothly.

Here are some things to consider when you’re setting up your payroll processes:

💰Paying new employees is different than paying freelancers

Employees and freelancers are two different types of workers, and therefore there are fundamental differences in their employment relationships. While they may be doing similar jobs, how the company pays them is different.

Here’s a breakdown of a few key distinctions between paying employees and paying freelancers:

Payment terms 💸

Employees: Employees get a steady paycheck, whether it's a monthly salary or hourly wage. To put it simply, payment is predictable and reliable.

Freelancers: Freelancers live on a project-to-project basis. It's all about negotiating fees for each project, and payment terms can vary depending on the payment they agree to with the client.

Tax time 📊

Employees: Employers handle the tax game for employees, pulling out income taxes, Social Security, and Medicare from their paychecks. Plus, employees typically get perks like health insurance, retirement plans, and paid time off.

Freelancers: Companies pay freelancers without withholding taxes or benefits and freelancers handle their own taxes. Traditional work benefits (like health care insurance and paid time off) aren't usually available from the company.

⚖️ Compliance with legal requirements.

While laws differ based on both the employer and employee’s location (including remote employees), some basics hold true across the board. Always be sure to check all local labor and tax laws to make sure your organization is in compliance.

Here are some general rules to abide by:

Taxes and deductions: Employers must accurately withhold and remit income taxes like Social Security and Medicare contributions from employee paychecks. They must also submit accurate tax reports to the relevant tax authorities (i.e. the IRS). Keep in mind that the company will also have to remit payroll taxes.

Classifying employees properly: Companies must classify employees as either hourly or salary (exempt or non-exempt). For example, hourly workers are able to get overtime pay while salary employees typically do not. How they’re paid will vary based on their classification.

Wage and hour laws: There are federal laws that govern minimum wage, overtime pay, and working hours. All employees need to make at least minimum wage and be paid for overtime work if they qualify.

Anti-discrimination laws: Compliance with anti-discrimination laws ensures that payroll practices do not discriminate against employees based on factors such as gender, race, age, or disability.

Employee benefits: Depending on your organization, you may be required to provide employees with benefits like health insurance or retirement plans. The employee portion of these expenses are typically deducted from their paycheck.

Record keeping: Keeping accurate and up-to-date records is a key component of compliance. This includes records of hours worked, wages paid, tax withholdings, etc.

Local regulations: Sometimes there are additional requirements beyond federal laws. Employers need to be aware of and follow all applicable regulations. This includes laws in every location they operate.

Why the payroll onboarding process matters

An employee’s first day is hectic enough. They’re reviewing the employee handbook, and getting their bearings with the new role. They may even attend check-ins with peers and supervisors. This doesn't even include the specific training sessions they have to attend. Talk about information overload. 🥴

Having a clear and simple new employee onboarding process for payroll helps give the new hire a great first impression of the company. This process should ensure you’re meeting all legal requirements.

You'll need to verify documents for the federal I-9 form and have them fill out tax forms like the W-4 Form for employees or the W-9 Form for freelancers. You should also include information about direct deposit and withholding employee benefits from their paycheck. 📝

3 steps to simplify the payroll onboarding process

When an employee is stepping into a new job, it can be intimidating. Remember, day one sets the tone for the employee’s experience with the company. You want them to see a company culture that makes them want to stick around.

Here are a few ways to streamline the process. 🤓

1. Create a payroll onboarding checklist 📝

Having a payroll checklist template is an important part of onboarding best practices. It makes the process seamless for both the new hire and the HR team (or whoever is doing the employee onboarding). Plus, it ensures you aren’t forgetting anything in the midst of the first-day chaos! 🤪

It should include a list of at least these things:

✅ Any company policies on payroll

How often do your employees get paid? Is there a paid time off policy? Anything that revolves around payroll or an employee's paycheck should be covered during the payroll onboarding process. 📄

✅ Employee’s contact information

Many payroll systems require information like legal name and address (sometimes phone number) especially if you’re going with direct deposit. 🏠

✅ Tax and other legal forms

Every employee will have to fill out state and federal tax forms like the W-4. These should be filled out on the first day and input into the payroll system ASAP to avoid costly errors. You want to make sure you have all our payroll ducks in a row for your new employees. 🦆

✅ Direct deposit

Yes, your new hire is there because they’re a good fit for your company. But, ultimately, they are there because they want to get paid. Be sure they fill out the direct deposit form so they can get their paycheck on time. ⏰

✅ Employee benefits withholding forms

If your employees are getting benefits like health insurance or retirement, those are considered pre-tax. That’s a fancy way of saying the portion employees pay is taken out of the paycheck before taxes are applied. Companies typically have withholding forms new hires need to fill out. 🖊️

2. Implement payroll policies 📋

An effective onboarding program will address all of the company policies and procedures. Think of this as a place to include everything an employee needs to know about payroll. Every organization, whether you’re a small business or a large corporation, should at least have these payroll policies in place:

💵 A direct deposit policy

💵 Withholding taxes and benefits from paychecks

💵 Time and attendance policies, like paid time off (PTO)

💵 How often employees get paid

💵 Where to direct payroll questions to (i.e. the HR department)

3. Use payroll software 💿

Payroll software can be a complete game changer for small businesses. It streamlines the payroll process and cuts down on hours of administrative time. There are several payroll automation solutions for small businesses and pricing to fit any budget. 💸

Let’s break down a few benefits of payroll automation:

It saves time and money. 💰

They say, “time is money,” and they aren’t wrong. Payroll software automates the manual process and frees up more of your time as a small business owner or as an HR department to focus on other things. 🔎

By automating payroll, you free up hours of time that you can then re-allocate back to the organization.

It makes for easier bookkeeping. 😄

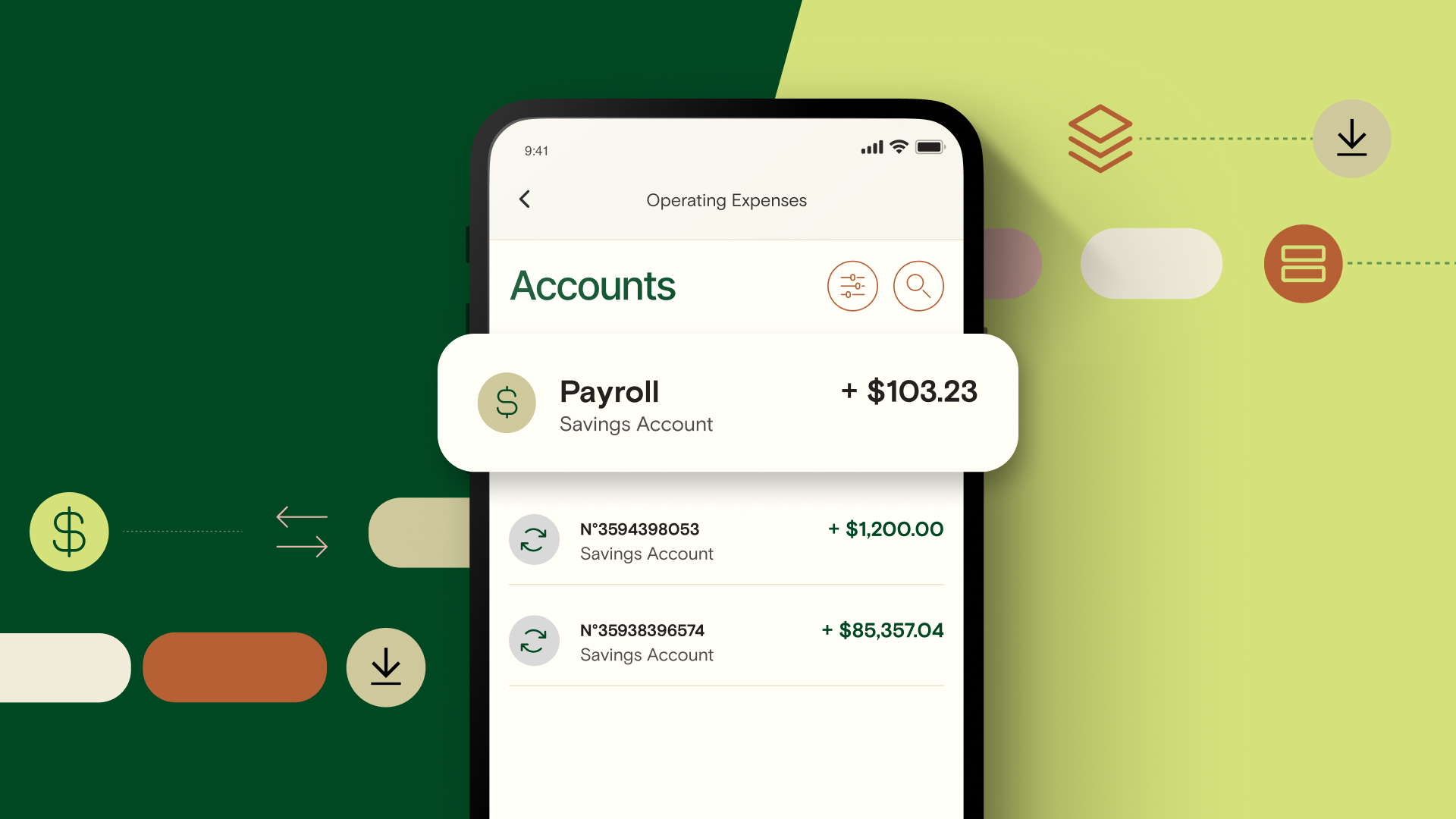

How much time are you spending trying to decipher your bank statements? Some payroll platforms, like Gusto, will integrate with your online banking platform, like Relay. (Oh hey, it’s us! 👋)

You’ll get to see detailed transaction data for every payroll cycle. No more pouring over your statements every month wondering what they mean. What will you do with all your extra time? 😅

Fewer compliance risks. ⚠️

Manual payroll processing can mean human error. Unfortunately, payroll mistakes can be costly (no pun intended). If the company doesn’t withhold the right amount of taxes it can result in fines and you definitely don’t want that! ❌

When you use software to automate the process, you’ll have more accurate records. That means avoiding getting tangled up with the IRS and having to pay fines. 😬

Tax filing made easy. (Umm, sign us up!) 🗂️

Taxes are equal parts boring, overwhelming, and stressful. No one likes doing them. That’s where the Gusto-Relay integration comes in. ✅

You get all your data in one place, making reporting your business tax return easier. And as a bonus, there’s an e-filing option, saving you even more time during tax season. You’ll rest easy knowing you have accurate records and calculations when filing your taxes. 📁

Lock down your data with better security. 🔒

Payroll systems come with the latest security features to protect your company and your employees or freelancers. They keep your data safe from security breaches or unauthorized access. 🥷

Payroll software also acts as a central database for all employee information. That means no more mistakes from manually updating records or calculating withholdings. You and your employees will also have secure access to important documents like tax forms and pay stubs. 🗃️

Stay on top of payroll with Relay and Gusto 💸

When you connect the payroll software, Gusto, to your Relay account, you’ll stay on top of payroll. Relay will help you by showing you detailed transaction data for every payroll cycle and debit type (like net salary, tax deduction, and reimbursement payments). Plus, we’ll send you a notification if your account is low on funds, two weeks before a scheduled payroll cycle. 🙌

Ready to get started with Relay? You can sign up here. 😎